Bitcoin’s August Curse Returns: Can BTC Hold $111K or Will Bears Take Control?

The crypto market holds its breath as Bitcoin flirts with the $111K threshold—another August proving why traders dread this month.

August Anxiety: A Seasonal Slump?

History doesn't repeat, but it rhymes. For the third time in five years, Bitcoin's August performance triggers flashbacks of 2022's brutal 15% monthly drop. This time, the $111K level becomes the line in the sand.

Whale Watching at Critical Support

On-chain data shows accumulation wallets loading up near $111K—either a smart bounce play or catching falling knives. Meanwhile, leveraged longs get liquidated faster than a meme coin rug pull.

The Institutional Wildcard

BlackRock's Bitcoin ETF saw $240M inflows last week despite the dip. Traditional finance still betting on the digital gold narrative—or just hedging against the dollar's accelerating decline?

Closing Thought: Maybe Satoshi coded this seasonal weakness to give Wall Street bankers their annual vacation buying opportunity. How... thoughtful.

ETF Outflows Deepen as Profit-Taking Accelerates

US spot bitcoin ETFs posted their largest single-day redemption on record August 1, with $812 million withdrawn, according to CryptoQuant. The week ending August 1 saw $643 million in the net outflows, ending a seven-week streak of $10 billion in cumulative inflows.

BlackRock’s iShares Bitcoin Trust (IBIT) has been a focal point, losing $292 million in August. Along with BlackRock, other ETF players such as Fidelity’s FBTC also oversaw massive outflows, suggesting that investors who entered during the early-year HYPE are now systematically taking profits off the table following July’s powerful rally. Month to date withdrawals for BTC ETFs have now surpassed $1,14 billion.

CryptoQuant analyst ArabaxChain noted, “ “ETF inflows were intermittent and not stable during periods when funds were withdrawn from ETFs. There was no alternative demand to compensate for this shortfall.”

Whale Watch: Dormant Coin Awakens and Move to Exchange

On Chain data reveals that the selling pressure is not just from new investors. The Exchange Whale Ratio remains stubbornly high above 0.70, indicating that large scale players are dominating exchange deposits.

A long term dormant Satoshi Era Bitcoin wallet suddenly became active in July transferring more than $1.26 billion worth of BTC $1.18 billion worth of Bitcoin to major exchanges like Binance, Bybit, Bitstamp, Coinbase, and OKX. Exchange inflows have risen steadily since early July, with Binance alone overseeing 5300 BTC/ day to over 7000 BTC/ day.

More concerning is the rise in Coin Dormancy, a metric that tracks the average age of coins being spent. A spike in dormancy suggests that long-term Holders (LTHs) who have held their Bitcoin for years are beginning to MOVE their coins to exchanges likely to sell.

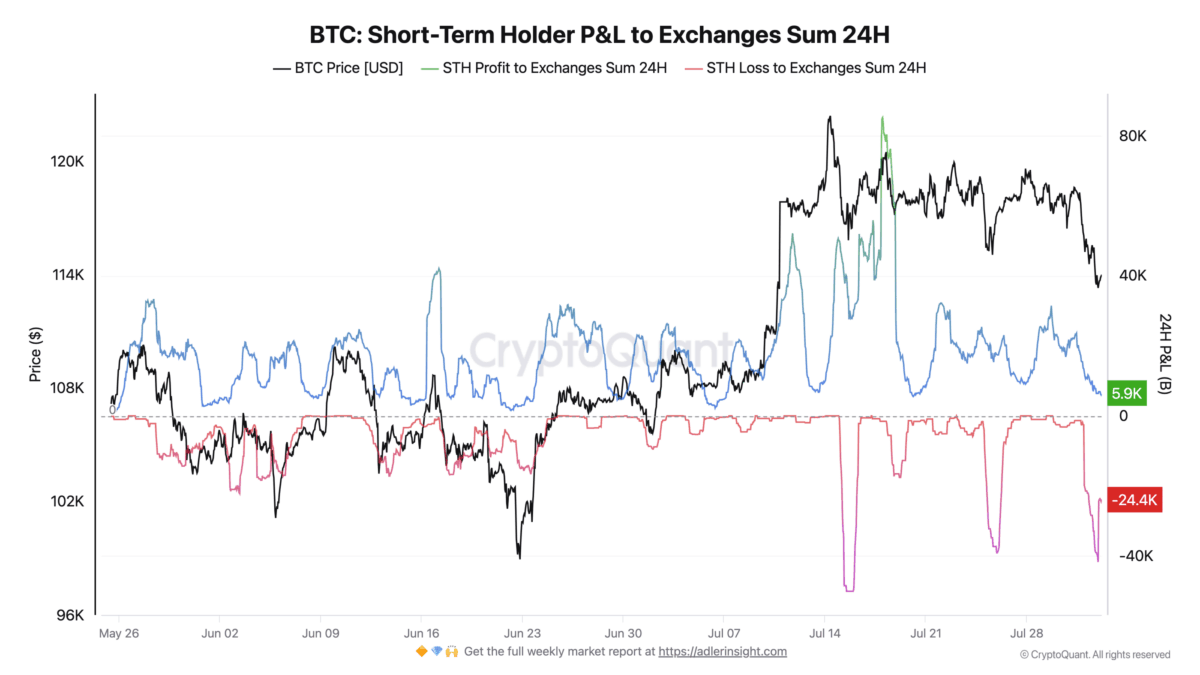

On August 1, over 16,417 BTC flowed into exchanges, coinciding with data showing short term holders (STHs) capitulating by selling 40,000 BTC at a loss. The Short-Term Holders SOPR ( Spent Output Profit Ratio) dipping below 1 confirms this, as it shows recent buyers are selling for less than they paid.

Time To Buy The Dip?

Despite the pullback, structural market conditions remain supportive of a longer-term uptrend. BTC’s July month close was the highest in its history. The recent drawdown appears more corrective than capitulatory. Regulatory clarity is improving, stablecoin integration is accelerating, institutional tokenization initiatives continue to gain traction.

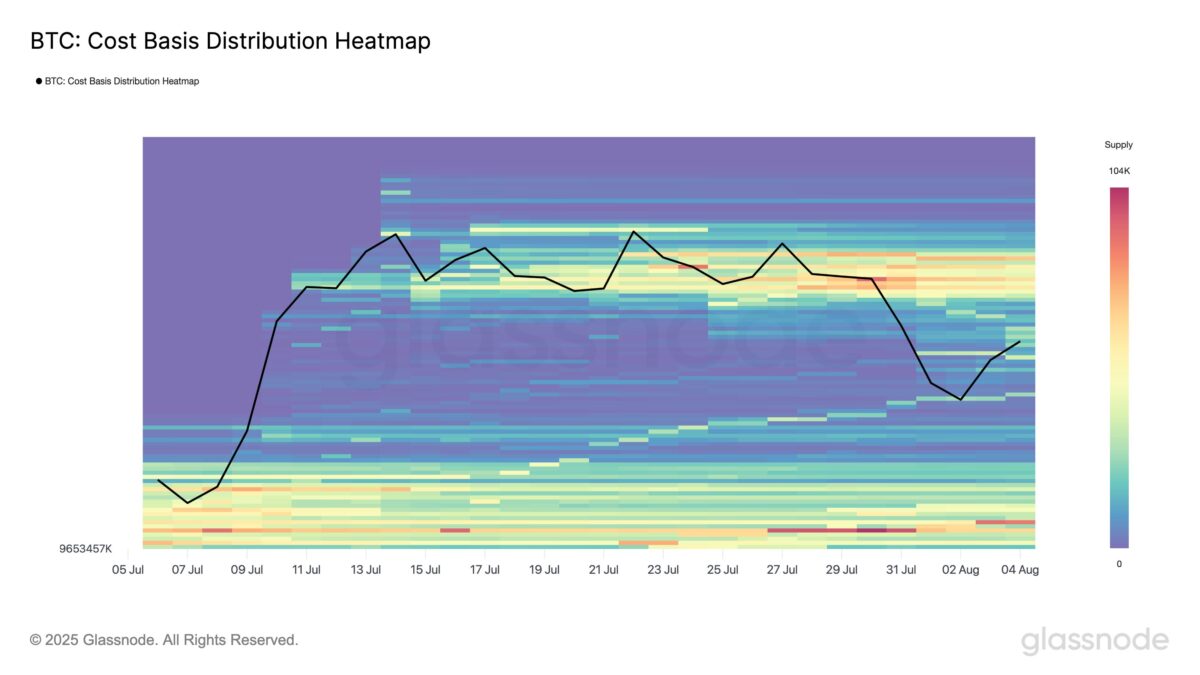

On-chain cost basis data suggest steady dip buying. Glassnode reports that the”airgap” between $109K and $116K is gradually being filled during price drops, forming a staircase pattern over the past month.

Importantly, there is limited distribution from the $118K-$120K range, suggesting that holders in this zone are choosing to hold through volatility rather than selling into weakness. As market watcher Songbird put it: “Buyers appear steady on dips”

In derivatives markets traders are already positioning for a rebound. Demand for BTC 29AUG25 call flys at $118K/$124K/$126K shows there are still many who believe the price will rally again. Their confidence in BTC highlights as they bet on a move above prior all time highs by month-end.

Digital Asset consultant QCP reports, “Spot levels near $112k warrant vigilance, especially amid persistent macro uncertainty. But signs of stabilization, such as renewed spot ETF inflows, declining implied vols and a narrowing of skew, WOULD be constructive signals that institutional sentiment is recovering.”

Rich Dad Poor Dad Author, Robert Kiyosaki also echoes this sentiment as he said, “ If the Bitcoin August Curse hits and Bitcoin crashes, I stand by to 2x my position today.”

Technical Picture: Retest and 50-Day MA Hold

BTC had a NEAR perfect retest of previous high over the weekend and held above its 50 day moving average, a key technical line for medium term trend support. According to CEO of Coinbuerue, Nic Pukrin, the setup is looking good ahead on the charts. This resilience combined with dip buying behavior, indicates underlying demand remains in play.

Bitcoin had a near-perfect retest of the previous highs on the weekend.

We also managed to hold above the 50day MA.

Looking good here ✅ pic.twitter.com/YZkK0aRoyL

However, well known analyst, Ali Martinez identifies $111,000 as the most important short-term support. “If it breaks, the next key demand zone sits around $90,000, according to the Pricing Bands.

$111,000 is a critical support level for Bitcoin $BTC. If it breaks, the next key demand zone sits around $90,000, according to the Pricing Bands. pic.twitter.com/XfWbofw7ZS

— Ali (@ali_charts) August 5, 2025He further notes that the last two times the weekly RSI dropped below the 14 SMA BTC price corrected by 20% to 30%. If history repeats, we could see a move down to $95,000!

What to Watch Next?

Key metrics to monitor for potential sentiment reversal include:

If these matrics improve alongside continued dip buying, the sell-off could transition into a buy-the-dip opportunity rather than a prolonged correction.

Also Read: Bitcoin Mining Difficulty Hits Record 127.6T, Slight Drop Expected

This content is for informational purposes only and does not constitute financial advice. crypto asset investments carry regulatory risk and may not be suitable for all jurisdictions.