Global Money Supply Skyrockets to Record High—Is Bitcoin the Next Bull to Charge?

Central banks keep printing, but will digital gold steal the show?

As fiat currencies drown in liquidity, Bitcoin stands tall—defiant, decentralized, and itching for a fight. The money printer’s gone berserk (again), yet crypto’s poster child refuses to kneel. Correlation or causation? The market’s about to decide.

Here’s the kicker: while traditional finance drowns in cheap cash, Bitcoin’s hard cap stays rock-solid at 21 million. No backroom deals, no surprise inflation—just code-enforced scarcity. Wall Street’s still scratching its head.

One cynical footnote: If history repeats, banks will first deny Bitcoin’s rise… then quietly accumulate. Old money’s playbook never changes.

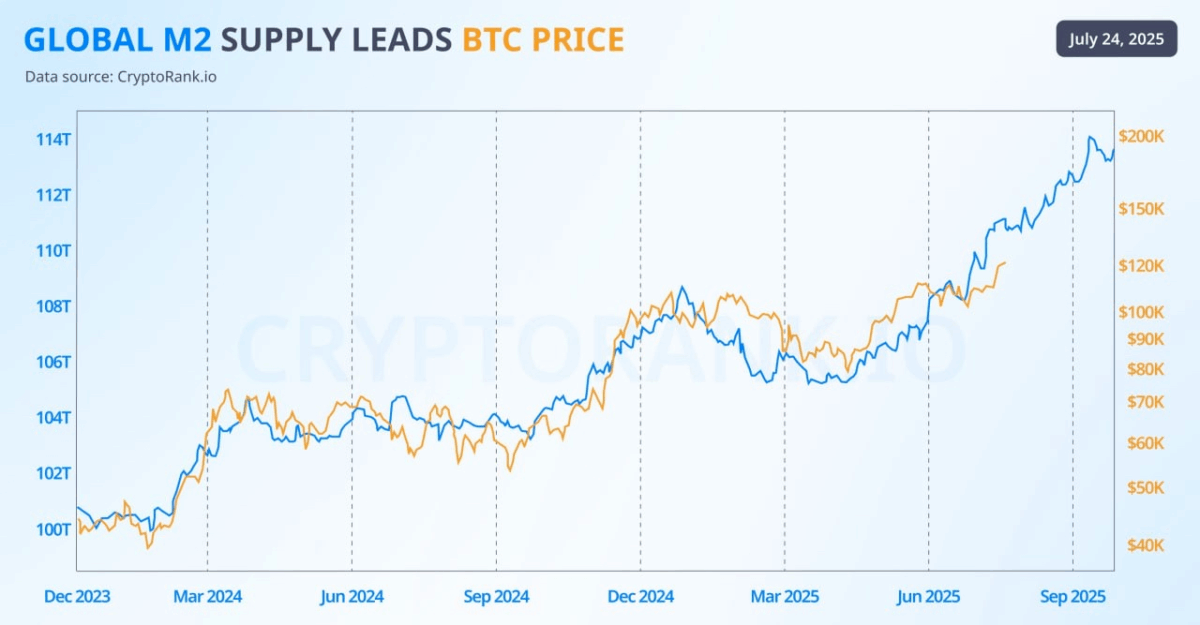

Liquidity Growth Fuels Crypto Optimism

According to historical data from the Federal Reserve, the U.S. money supply expanded steadily from the 1960s to the early 2000s. The biggest surge came during the 2020 COVID-19 pandemic. In just a year, M2 jumped from $15 trillion to over $21 trillion due to stimulus checks and monetary easing.

In 2022, M2 experienced a slight decline as the Fed increased interest rates and reduced spending. This downturn also happened as Bitcoin went down. However, with liquidity on the rise once more, the environment seems good for Bitcoin to follow suit.

Besides, more dollars in the system often drive capital into hard assets. Bitcoin is set to benefit as global M2 continues climbing. Hence, if history repeats, Bitcoin could soon follow a similar path as the liquidity spike and resume its upward momentum.

Also Read: Bitcoin Plunges Under $115K, Sparks $530M Liquidation Wave