🚀 Ethereum (ETH) Supply Crunch Incoming: Analysts Now Eye $10K Price Target

Ethereum's next bull run might come with a twist—a supply shock that could send prices stratospheric. Here's why traders are scrambling.

The squeeze play: With ETH staking locking up coins and institutional demand creeping up, available supply could soon hit a critical low. When that happens? Buckle up.

$10K or bust: Some analysts see this perfect storm pushing ETH past five digits—assuming the network doesn’t get bogged down by gas fees again (old habits die hard).

Wall Street’s FOMO moment: Watch for the usual suspects—hedge funds and crypto ETFs—to pile in late, as always, then pretend they invented decentralized finance.

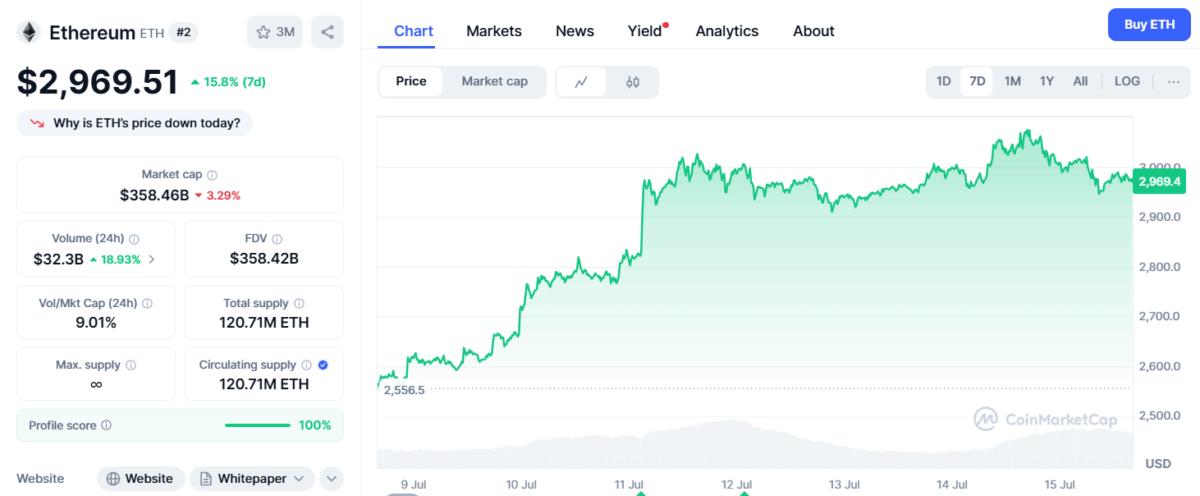

Source: CoinMarketCap

Source: CoinMarketCap

Analyst Predicts ETH Price Soaring to $10,000

Speculating on the current price trajectory of Ethereum (ETH), market analyst and Founder of MJ Capital, Eric Jackson predicts that ETH price will be reaching $10,000, and its next leg up will catch everyone off guard.

Eric believes that the approval of ethereum ETFs are still not priced as it is awaiting the approval of Staking ETFs, which will further solidify ETH’s position in traditional finance markets. “The real catalyst is still ahead: staking approval, expected before October,” Eric said, “Once that hits, ETH becomes the first yield-bearing crypto ETF in U.S. history.”

Most people think the ETH ETF approval is already priced in and it’s been a big bust vs. BTC (in terms of assets for $ETHA vs. $IBIT).

It’s not.

Because the real catalyst is still ahead: staking approval, expected before October.

Once that hits, ETH becomes the first…

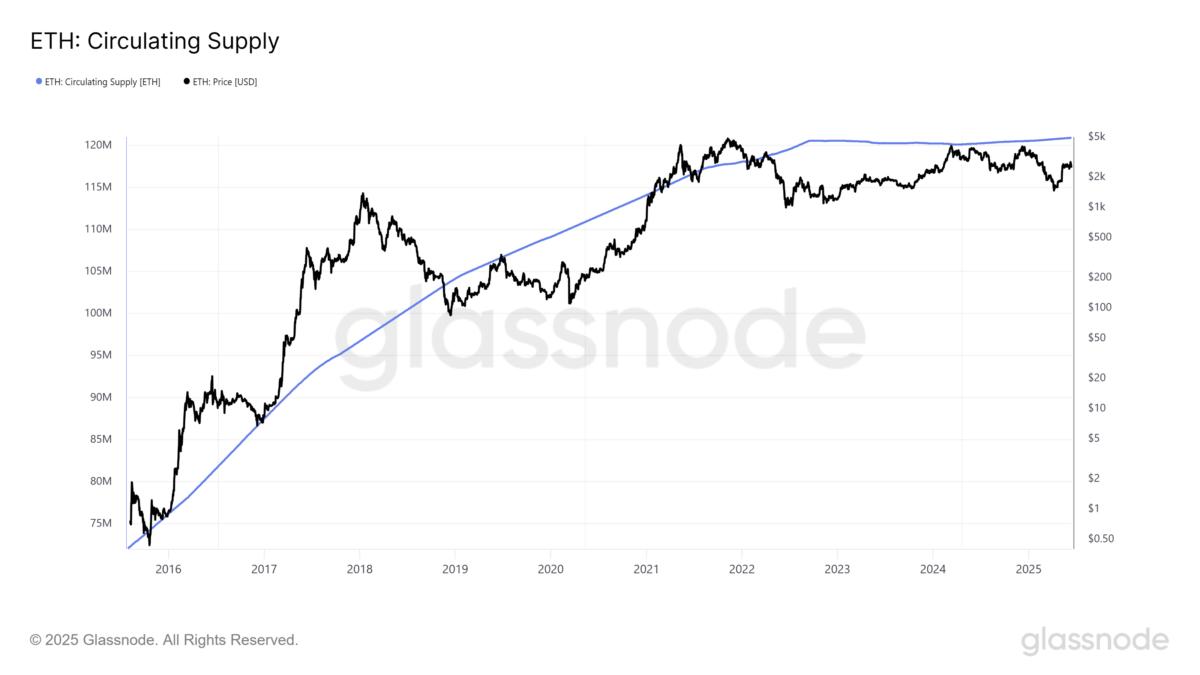

The staking Ethereum ETF will enable investors to earn passive yields and essentially increase the asset’s market demand. As ETH issuance has also turned negative in post-Merge timeline and existence of spot ETH ETF has increased its demand, it would likely lead to a structural supply crunch for the cryptocurrency.

“Our analysis suggests the ETH network is underpriced. It generates real revenue,” Eric Added, “And once ETH becomes a productive, staked asset within an ETF wrapper, It’s no longer just digital oil, It’s an institutional-grade yield product.”

ETH Supply Crunch Incoming?

Ethereum’s current market supply stands at 120.71 million, which has maintained a steady pace of supply-burn ratio after the implication of the Merge upgrade in September 2022. This balanced supply and increase in ETH demand are the key basis on what Eric predicts an incoming supply shock.

While unsure, the increasing attention on Ethereum–as an institutional grade asset–would likely impact heavily on its market price. Predictions such as $10,000 per ETH may currently look ridiculous, but given the “supply shock” scenario, the target seems reasonable.

Also read: Bitcoin Pulls Back Below $117K As Profit Taking Hits