🚀 Ethereum ETFs Explode: $908M Floods In as ETH Shatters $3,000 Barrier

Wall Street's crypto crush just got hotter—Ethereum ETFs are swallowing cash like a bull market black hole.

### The ETH Surge: More Than Just a Number

With $908 million racing into Ethereum ETFs last week, institutional money isn't just dipping toes—it's cannonballing into DeFi's deep end. Meanwhile, ETH's blistering rally past $3,000 has traders high-fiving and skeptics scrambling for explanations (or maybe just aspirin).

### The ETF Effect: When 'Boring' Finance Meets Crypto Volatility

Traditional finance finally found its on-ramp—wrap crypto in a regulatory bow, and suddenly pension funds are 'degen lite.' The irony? Ethereum's decentralized ethos now thrives between the same custodial walls it was built to escape. Poetic—or just Wall Street doing what it does best: commodifying rebellion.

### What's Next? A Reality Check—Or Higher Highs?

Sure, $3,000 ETH feels like victory laps and rooftop parties. But remember: in crypto, every 'new paradigm' comes with a side of 'this time it's different' delusion. Whether this is the start of a sustained uptrend or another bubble waiting for a pin—well, that's why they pay traders the big bucks (when they're right).

Ethereum tops $3,000 as ETF inflows hit record highs.

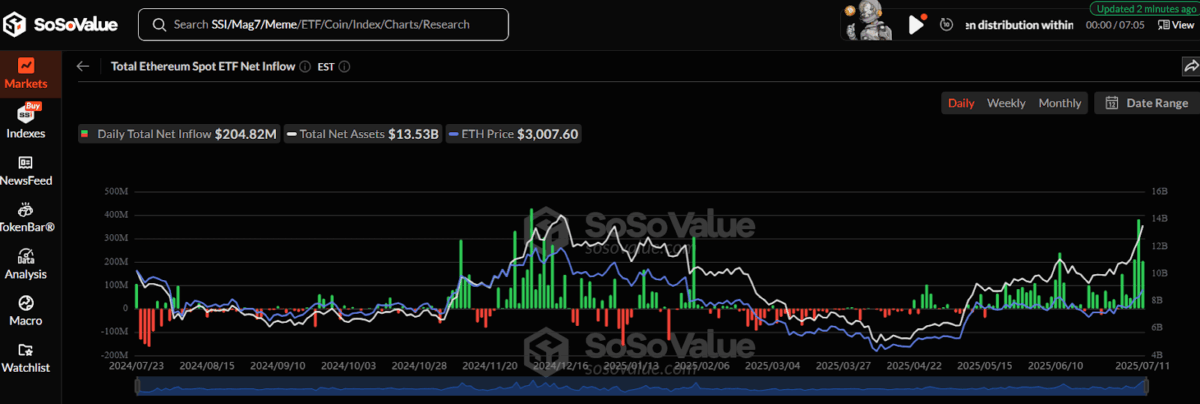

As per statistics, ethereum ETFs grew $907.99 million in the last week, their best week ever. July 10 was the biggest one-day inflow when $383.10 million flowed into the market. July 9 and 11 also made their way into the top 10 inflow days with $211.32 million and $204.82 million in inflows, respectively.

Nate Geraci, head of The ETF Store, called the week a watershed moment for Ethereum ETFs, as it saw three of the top 10 biggest inflow days in their history.

BlackRock’s iShares Ethereum Trust (ETHA) led much of this inflow, adding $156 million of ETH on July 10 more than its Bitcoin ETF added on the same day. ETHA now has more than 2 million ETH valued at over $300 million.

Bloomberg’s wrote about ETHA’s pace, stating that the fund was sixth overall for U.S. ETFs in weekly inflows, describing it as a clear indicator that Ethereum is gaining serious institutional interest.

Ethereum Shows Bullish Indicators

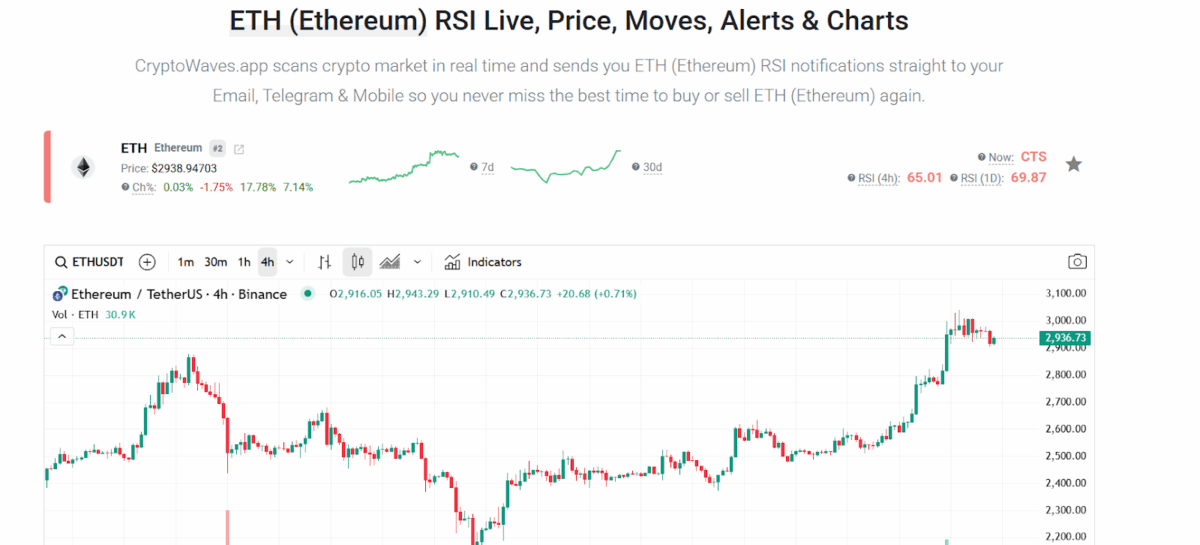

Technically, Ethereum is giving strong bullish indications. The ETH price recently broke out of a bull flag pattern on the daily chart, indicating a continuation towards a probable target of $4,000.

$ETH printed a daily gain of the crucial $2,800 resistance.

Ethereum to $4,000 is next. 🚀 pic.twitter.com/pbxqs9yMO3

The breakout was accompanied by rising volume and a strong close above the $2,742 resistance level, with the base of the flag running from $1,540 to that breakout point. This poses a possible 78% rally if the pattern goes to completion.

Open interest in Ethereum futures has also risen, hitting a multi-month high of $42 billion. Meanwhile, derivative volumes ROSE 39% to $126 million, indicating rampant speculation.

Coinglass reports indicated that more than $219 million worth of short positions were liquidated in 24 hours, adding to the further upward pressure.

Ethereum’s Relative Strength Index (RSI) currently sits at 71, within overbought levels yet still below its previous highs. Historically, in cycles, ETH has gone above an RSI of 80 before it turned back, and there may still be room for upwards movement.

Institutional buying, technical breakouts, and a positive on-chain setting are all converging to push Ethereum’s momentum. With ongoing ETF inflows and increasing market appetite, ETH may be well-positioned to challenge new all-time highs in the NEAR future.

Also Read: BlackRock Now Manages Over 2 Million Ethereum in ETF