Bank of America Declares Bitcoin the Undisputed Champion of 2025’s Currency Race

Move over, fiat—Bitcoin just lapped the competition.

Bank of America's latest analysis confirms what crypto bulls suspected all along: Bitcoin isn't just outperforming traditional currencies in 2025, it's rewriting the rulebook. While central bankers fiddle with fractional reserve ratios, Satoshi's invention keeps minting new all-time highs.

The numbers don't lie

No other store of value comes close to BTC's triple-digit ROI this year—not gold, not bonds, certainly not your savings account collecting 0.5% interest behind three KYC hurdles. The orange coin's volatility? Now looking more like a feature than a bug as it steamrolls inflation metrics.

Wall Street's backhanded compliment

Even traditional finance giants can't ignore these returns, though you'll still hear them muttering about 'speculative bubbles' between client meetings. Pro tip: When the suits start calling your asset class 'digital gold,' check your portfolio—they're probably already long.

One question remains: How long until the IMF starts 'expressing concerns'?

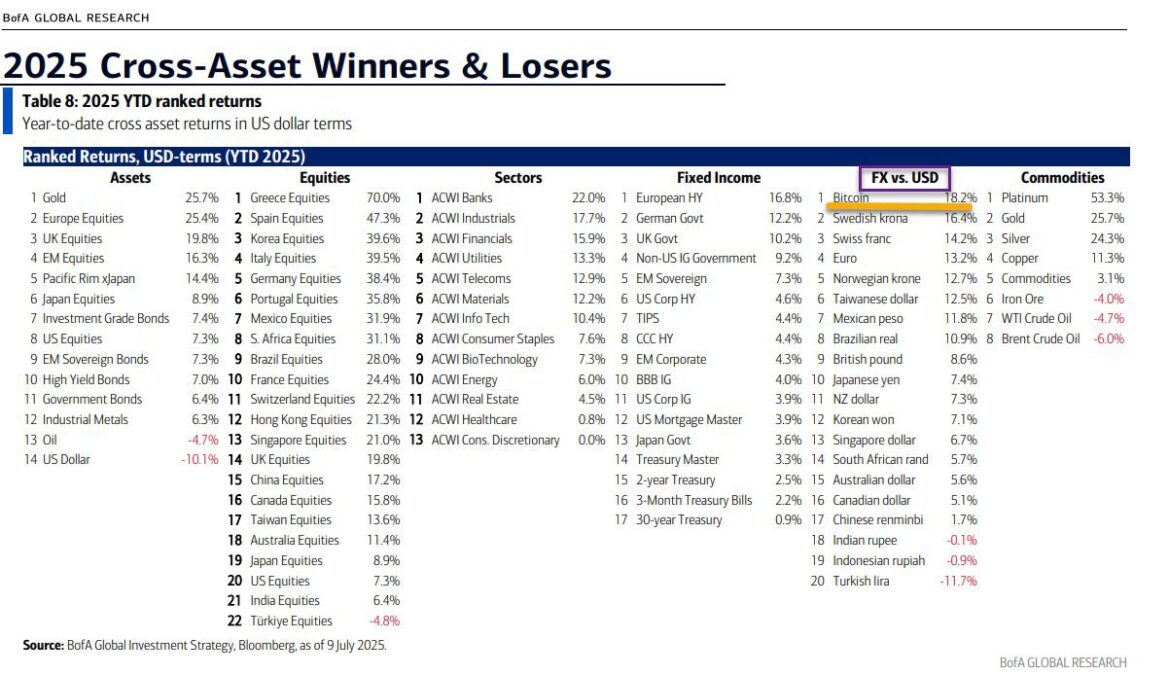

Bitcoin Tops 2025 Currencies

As per the report, bitcoin registered an 18.2% year-to-date (YTD) increase up to July 9, beating the Swedish krona (+16.4%), the Swiss franc (+14.2%), and the euro (+13.2%). The U.S. dollar, on the other hand, had a YTD decrease of 10.1%, which ranked last among 14 tracked currencies.

What makes this all the more important is that Bank of America included Bitcoin in the currency category not merely as a speculative vehicle. This change in classification marks increasing institutional recognition of Bitcoin as a viable alternative to fiat, and potentially even a long-term store of value.

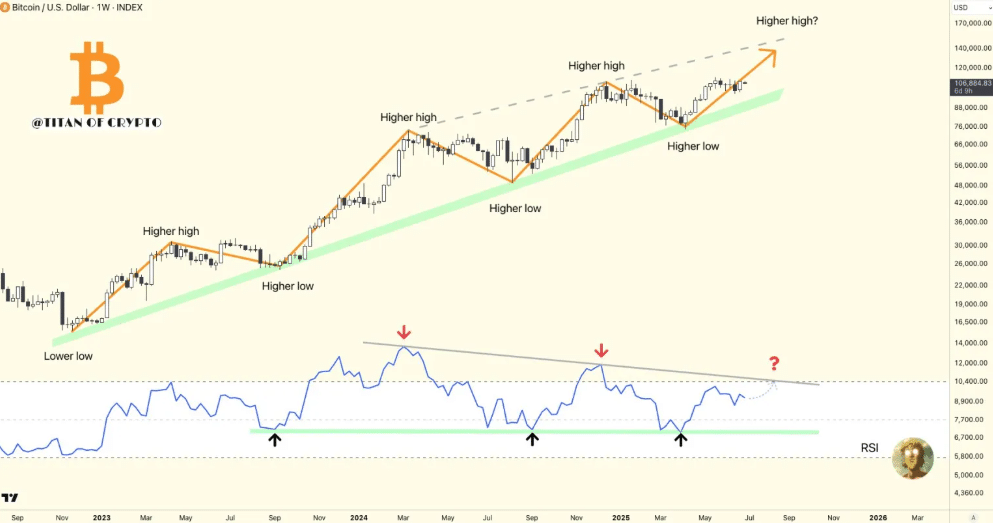

The approval is at a time when Bitcoin is riding a strong rally. On July 11, BTC hit a new all-time high of $117,979 with high trading volume and an increasing Relative Strength Index (RSI) of 73.56, which shows high market momentum. Bitcoin has been steadily rising since early June, breaking new highs on three successive days.

Through today, Bitcoin’s year-to-date is even higher at nearly 26% more firmly establishing itself as the top-performing currency and many traditional assets.

Analysts point out that the recent Bank of America reclassification comes on the heels of a wider shift in sentiment. What was a speculative bubble just a few short years ago is now being mainstreamed by large institutions as part of the global finance staple.

This new MOVE by Bank of America is the latest addition to the increasing narrative of Bitcoin’s transformation from a digital experiment to a known financial giant.

Also Read: If Bitcoin price Hits $350K, Satoshi Becomes The Richest Person