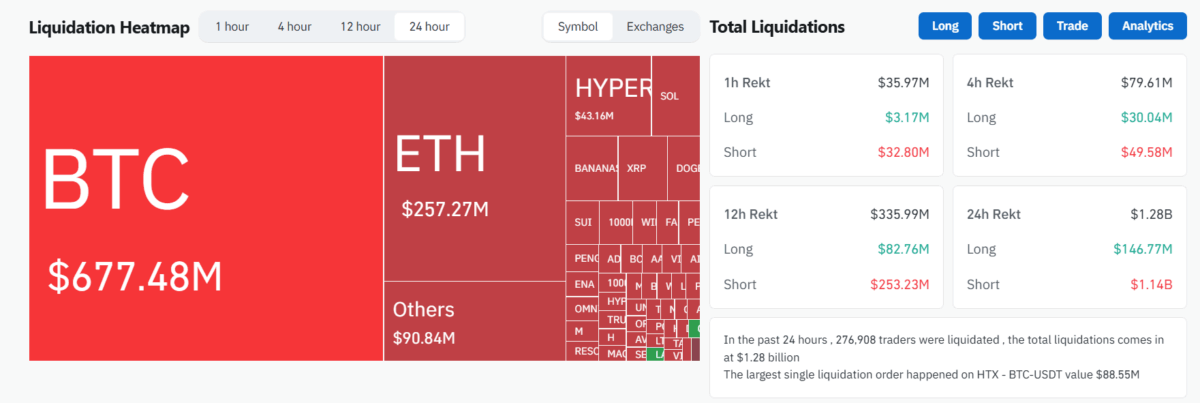

Crypto Carnage: Short Traders Get Obliterated as $1.14B Liquidation Tsunami Hits Amid BTC & ETH Rally

Blood in the crypto streets—bearish traders just got steamrolled by a $1.14 billion liquidation massacre. Bitcoin and Ethereum’s relentless surge turned leveraged short positions into smoking craters overnight.

When the whales move, minnows get eaten. The latest price pumps didn’t just break resistance levels—they broke portfolios. Meanwhile, Wall Street ‘experts’ still can’t decide if crypto’s a scam or the future. Spoiler: it’s both.

Pro tip: betting against digital gold while the Fed prints monopoly money? Bold strategy. Let’s see how that works out post-halving.

Liquidation Heatmap, Source: CoinGlass

Bitcoin hit a new all-time high above $118K today, setting a new record after a breakout above $112,000 the day before. Ether followed closely, rising past $3,000. The sharp MOVE upwards surprised many in the market and triggered what some called a major short squeeze.

Crypto market cap rose by 6.39% in one day, now sitting at $3.69 trillion, based on data from CoinMarketCap. crypto analyst Miles Deutscher posted on X, “Bears in disbelief,” while trader Daan Crypto Trades called it a “MASSIVE Short squeeze on BTC & ETH.”

Earlier this week, some analysts expected the Bitcoin price to lose buy momentum and reverse after nearing the previous ATH. On July 8, Bitfinex analysts said traders were showing “a lack of follow-through strength,” with bulls unable to move prices higher without clear signals or strong news.

Others had a more positive view. On June 30, Michael van de Poppe, founder of MN Trading Capital, said, “The inevitable breakout to an ATH on bitcoin might even happen during the upcoming week.”

Now that Bitcoin has reached a new ATH, some traders are staying cautious as Bitcoin’s pull back below current levels WOULD lead it to drop back to $112,000, which would put over $2.1 billion in long positions at risk.

For now, the market is holding steady. And traders are watching closely to see if the rally continues or if more liquidations follow.

Also Read: Bitcoin ETFs Hit $1.18B in Inflow as bitcoin price Hits All-Time High