🚀 Hyperlane (HYPER) Explodes 300%: The Secret Behind Crypto’s Hottest Rocket

HYPER just left gravity behind—here's why traders are scrambling aboard.

The Interchain Liquidity Superhighway

Hyperlane's modular interoperability protocol is eating competitors' lunch. While legacy bridges creak under congestion, HYPER's permissionless connections between 50+ chains slash cross-chain settlement from minutes to seconds.

VCs vs. Degens: The Pump Paradox

Coinbase Ventures' recent investment sparked institutional FOMO, but let's be real—retail traders are juicing this rally with leveraged longs. The HYPER perpetuals funding rate just hit 0.15% daily (translation: unsustainable).

Tokenomics That Don't Suck

Actual utility? Wild concept. 65% of HYPER's supply fuels network security and governance—a rare case of a token doing more than enriching early investors (though they're doing just fine).

The chart says moon. The fundamentals say maybe. Your portfolio says 'YOLO.' Welcome to crypto's latest love affair with vaporware that might—just might—change everything.

Source: CoinMarketCap

Source: CoinMarketCap

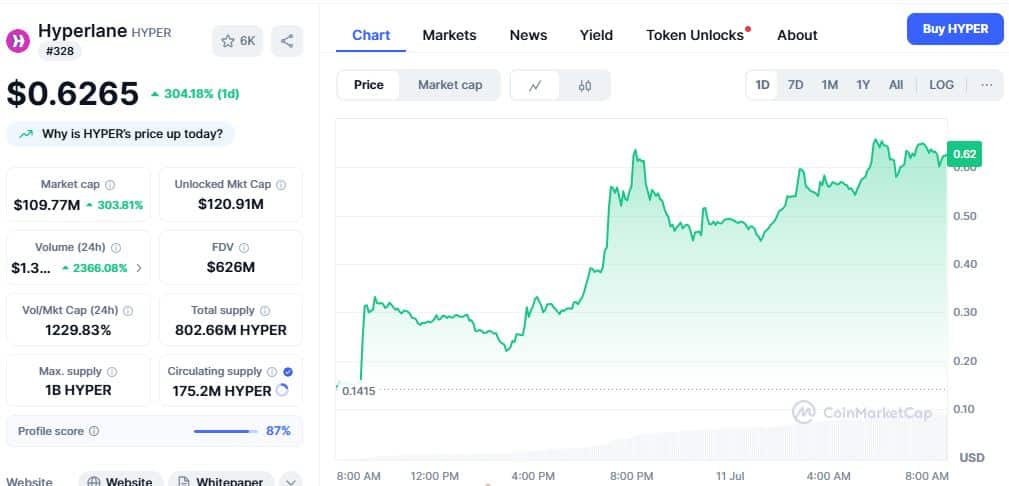

Today, Hyperlane’s market cap has climbed to around $109 million, with its price settling close to $0.62, a huge leap from where it was just a few days ago.

On the charts, HYPER broke through key price barriers and even triggered a wave of short sellers closing their positions as it moved past $0.60. Indicators show it’s running hot, with overbought signals flashing across charts, but traders haven’t backed off yet.

While Hyperlane enjoyed its breakout moment, the broader crypto market is also in rally mode. Bitcoin has pushed past $116,000, while Ethereum is now approaching $3,000. Combined, both have helped lift the total crypto market cap to $3.47 trillion, up 2.28% in the last 24 hours.

The question now is whether Hyperlane’s momentum can last beyond the initial hype, or if this was a classic listing-driven surge. Either way, for now, HYPER is the name everyone’s watching.

Also Read: Kinto Token Price Crashes 90%: Investors Accuse Team of Rugpull