Ethereum ETFs Explode: $211M Floods In as Smart Money Bets Big on ETH

Wall Street's crypto crush intensifies as Ethereum ETFs rake in a quarter-billion-dollar wave—proof that even traditional finance can't ignore DeFi's crown jewel.

Why the sudden frenzy? Institutional FOMO meets ETH's unstoppable tech stack. The same suits who called crypto a scam last year are now scrambling for exposure.

Bonus cynicism: Nothing gets capital flowing like the fear of missing the next Bitcoin ETF gravy train—even if it means pretending to understand smart contracts.

Ethereum ETF inflow in the last 10 days | Source: Farside Investor

Ethereum ETF inflow in the last 10 days | Source: Farside Investor

This time, BlackRock led the charge with $158.62 million of the inflow. Fidelity followed with $29.53 million, while Grayscale pulled in $17.96 million. Franklin Templeton’s ETF added $5.21 million. Four Ethereum ETFs recorded positive flows, and none saw any outflows. Altogether, the total value traded reached $1.26 billion on July 9.

Altogether, the total value of all U.S. Ethereum spot ETFs is now $11.84 billion. This is about 3.6% of Ethereum’s total market value. Since these ETFs launched in July 2024, they have pulled in $4.72 billion from investors.

Meanwhile, U.S. Bitcoin spot ETFs brought in $218.04 million in net inflows on the same day. BlackRock’s Bitcoin ETF recorded $125.58 million in inflows, with Ark & 21Shares bringing in $56.96 million. These products have now crossed $50 billion in cumulative net inflows since launching in January 2024.

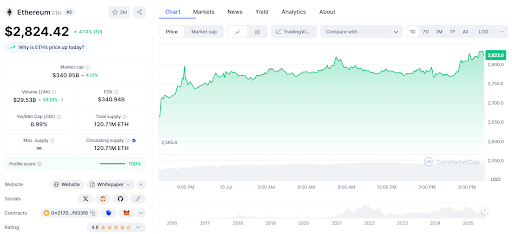

In addition, Ethereum surged 4% today. It went from a daily low of $2660.5 to now trading for $2824. It also picked up a significant number in trading activity today, with a 61% increase in volume to $29.5 billion.

Also Read: ethereum price Hits $2800 on Hyperliquid! What’s Happening?