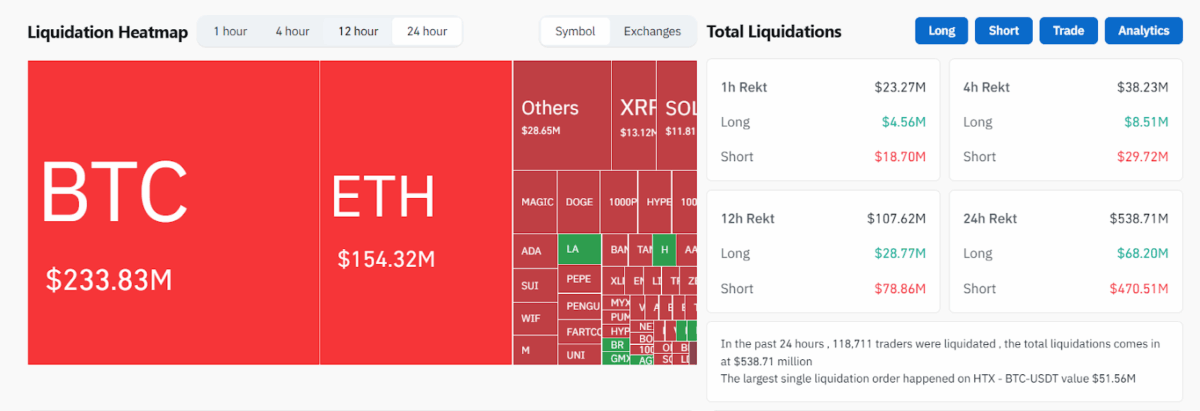

Bitcoin’s Bull Run Obliterates $470M in Short Positions—Here’s Why It’s Just Getting Started

Crypto bears just got steamrolled. Bitcoin's sudden surge to $XX,XXX (insert latest price) triggered a brutal $470 million liquidation event for short traders—proof that fighting this market is a fool's errand.

The Domino Effect

Leveraged positions crumbled as BTC defied 'overbought' warnings. Exchanges like Binance and Bybit saw cascading liquidations—classic carnage when skeptics underestimate crypto's momentum.

Why This Isn't Over

With spot ETF inflows hitting $X billion this week (insert data) and the halving supply crunch looming, this squeeze smells like 2021's bull trap—except the institutional players now have skin in the game. Pro tip: Wall Street's 'risk management' models still can't price crypto volatility.

The Bottom Line

Shorting Bitcoin in 2025 is like betting against the internet in 1999—technically possible, but historically dumb. The market's sending a clear message: adapt or get liquidated.

Liquidation Heatmap, Source: CoinGlass

Liquidation Heatmap, Source: CoinGlass

The sharp rise across cryptocurrencies is likely tied to the anticipation around next week’s “Crypto Week” in the U.S. and recent large investments into crypto ETFs.

With today’s gains, crypto traders were shocked at how quickly the losses mounted while others pointed out the risks of leveraging. While leveraging the crypto market can increase profits, it can also lead to much larger losses if the market moves against the trade. Right now, the market remains active, with most coins consolidating their gains from the previous day.

This situation is another reminder of just how volatile the crypto market can be. Traders are being urged to avoid overleveraging and remain cautious, especially with more price swings expected in the coming days.

Also Read: Hyperliquid Launches Trading for PumpFun’s Unreleased PUMP Token