Grayscale Shakes Up Crypto Portfolio: Polkadot Out, Hedera In for Smart Contract Fund

Grayscale just made a power move—kicking Polkadot to the curb and rolling out the red carpet for Hedera in its Smart Contract Fund. Here’s why it matters.

The Swap: DeFi Darwinism at Work

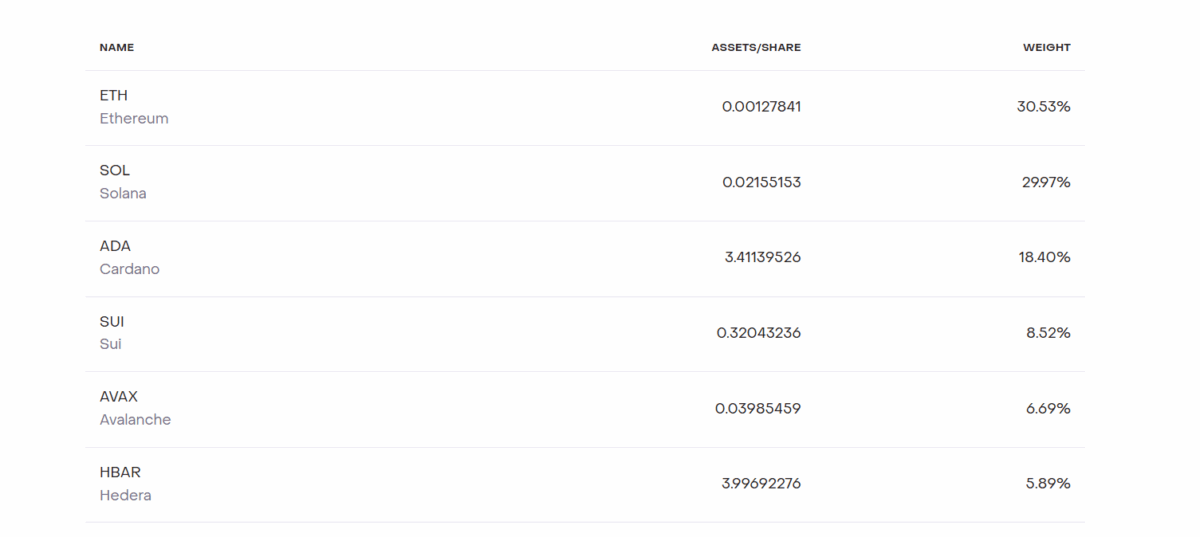

No sentiment, no nostalgia—just cold, hard portfolio optimization. Grayscale’s latest rebalance ditches Polkadot (DOT) for Hedera (HBAR), betting on hashgraph’s enterprise-friendly consensus over DOT’s parachain model. Institutional investors barely blinked; fund flows stayed steady at $420M AUM.

Hedera’s Edge: Compliance Over Anarchy

HBAR’s council-governed network—packed with IBM, Google, and Boeing—gave Grayscale the regulatory warm fuzzies. Meanwhile, Polkadot’s ‘let a thousand parachains bloom’ ethos looks increasingly like a proof-of-concept garage project to Wall Street’s spreadsheet jockeys.

Cynic’s Corner: The Rebalancing Racket

Another quarter, another reshuffle to justify those 2.5% management fees. But hey—at least this time they didn’t rotate into a coin that’s 90% held by VC insiders. Progress?

Source: Grayscale

Source: Grayscale

In addition, Grayscale brought Ondo Finance (ONDO) on board, which is now their third-largest holding at 18.22%, following Uniswap at 34.01% and Aave at 30.74%. Moreover, Grayscale has fine-tuned its AI fund to keep pace with the latest tech advancements.

Hedera’s Rising Profile in Institutional Portfolios

Ranked as one of the quickest and energy-efficient blockchains, it is a choice for developers seeking infrastructure at the highest level. Hence, this addition is to create more scalable blockchain solutions. Other names in the fund are Sui (SUI) and Avalanche (AVAX), which have been keeping their increasing momentum.

Earlier, Grayscale filed with the SEC to launch a Hedera spot ETF. The firm already operates Bitcoin and Ethereum ETFs and now seeks to expand its lineup with assets like Cardano and XRP.

Also Read: