MicroStrategy Doubles Down: $4.2 Billion Debt Raise to Fuel Bitcoin Buying Spree

Wall Street’s favorite corporate bitcoin whale is back—and it’s going all in.

MicroStrategy just fired the starting gun on a $4.2 billion debt offering, with every penny earmarked for more BTC. Because when your treasury strategy involves converting debt into volatile crypto assets, why stop at reasonable limits?

The move comes as bitcoin flirts with new all-time highs, proving once again that in finance, FOMO beats fundamentals every time. Meanwhile, traditional investors clutch their pearls while Saylor’s team reloads the war chest.

One thing’s certain: when the history of this era gets written, the chapter on ‘companies that treated their balance sheets like a Vegas crypto roulette table’ will have MicroStrategy’s name in bold.

Strategy Bitcoin Holding | Source: Arkham

Strategy Bitcoin Holding | Source: Arkham

During the quarter ending June 30, Bitcoin’s price jumped from around $82,000 to $108,000, which gave the company’s portfolio a significant boost. The company also raised $6.8 billion in the same quarter from a mix of capital market moves, which includes stock offerings and preferred stock sales.

It still has billions in available capacity under existing sales programs: $18.1 billion under the 2025 Common ATM, $20.5 billion under STRK ATM, and $1.9 billion under STRF ATM. MicroStrategy said the STRD stock program WOULD continue over time and depend on how much demand exists in the market.

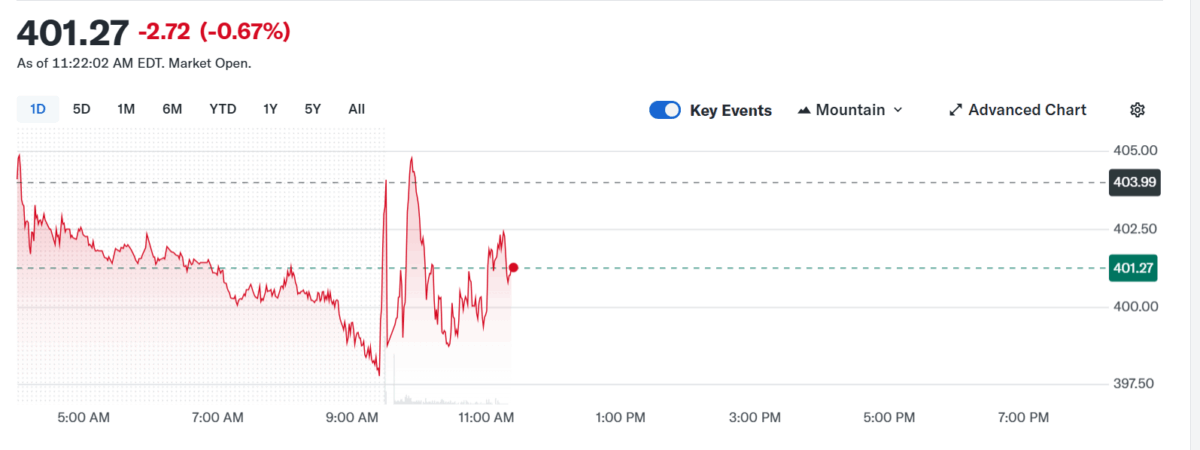

The STRD shares, which launched on June 11, have already surged by 6%. Nonetheless, even with the strong quarter, MicroStrategy shares (MSTR) were down 3.49% TO $400 in early Monday trading, as Bitcoin slightly dipped from recent highs.

At the time of writing this report, Bitcoin was priced at $108,006, up 2.21% today, with a significant amount of activity going on of up 25% to $40 billion, according to CoinMarketCap.

Also Read: Semler Scientific Expands Total Bitcoin Holdings to 4,636 BTC