Crypto Bloodbath 2025: Decoding BTC, ETH & XRP’s Nosedive—And Why It’s a Buying Opportunity

Markets don’t bleed without reason. Here’s what’s gutting crypto’s heavyweights—and why panic sellers might regret it.

The domino effect: Liquidity crunch or institutional sabotage?

When Bitcoin sneezes, altcoins catch pneumonia. The king coin’s 15% weekly plunge dragged Ethereum below critical support, while XRP got caught in the crossfire. Exchanges saw $2B in liquidations—yet derivatives data hints this isn’t your average leverage flush.

Macro ghosts haunting the blockchain

Fed chair Powell’s ‘higher for longer’ mantra just got teeth. With rate cuts postponed to Q4, yield-chasing capital fled crypto faster than a DeFi exploit. Funny how ‘risk-off’ narratives only apply when Wall Street needs scapegoats.

The silver lining for diamond hands

Network fundamentals scream accumulation phase: Bitcoin hash rate hit ATH pre-crash, Ethereum’s L2s now process 90% more transactions than mainnet. Smart money’s loading bags while retail tweets ‘RIP crypto’—some things never change.

BTC Witnessed Increasing Whale Selloff!

Over the past 24 hours, seven dormant whales have woken up once again. Notably, a total of $7.6 billion worth of Bitcoin. These whales are inactive from the past 14 years and were last activated between April & May 2011. This has resulted in BTC price dropping below its $108,000 mark.

🚨 BILLIONAIRE Bitcoin WHALE WALLETS ARE WAKING UP 🐳

Since last night, 7 ancient addresses have moved a combined $7.6 BILLION in #Bitcoin.

Each wallet dates back to April–May 2011, lying dormant for over 14 years 😳

Something big is brewing in the deep waters of crypto… pic.twitter.com/YFWxzXMzwn

Considering the present market sentiments, the Bitcoin price could retest its upper resistance of $110,500 within a short period. However, a bearish action could result in it dropping toward its low of $105,000 in the upcoming time.

Cryptocurrency Market Experiences More Liquidations!

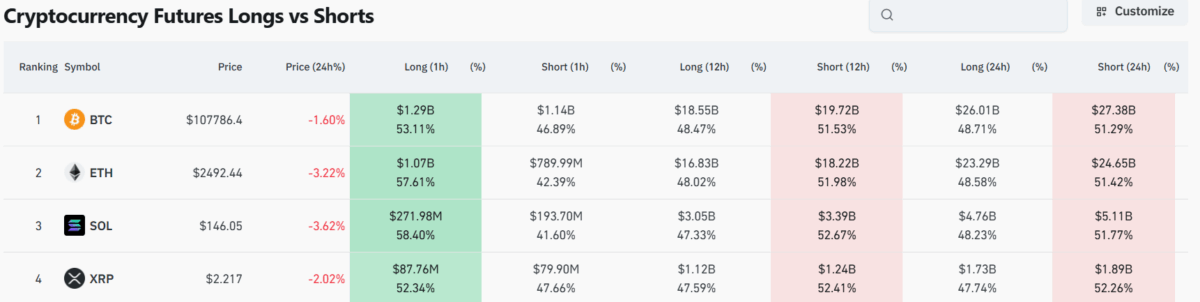

The below chart shows the variation between Bitcoin (BTC), ethereum (ETH), and XRP futures over the recent times. Notably, Bitcoin has a little bit more short against long over the 12H and 24H time frames. As per the data, 51.53% and 51.29% shorts respectively.

The largest altcoin, Ethereum, has lost 3.22% over the last day and is currently valued at $2,492. Moreover, the shorts occurred at 51.42%, suggesting bearish forces. However, when compared with short-term (1H) sentiment that is a report of 57.61% long.

On the other hand, the xrp price is currently at $2.217 and shows a steady bearish trend in all the timeframes with shorts constituting 52.26% over 24h. Additionally, the short term players are long and long term players are short indicating a note of caution in the larger market.

Diminishing hopes of Fed rate cut

With the next FOMC meeting only 26 days away, the chances of a FED rate cut in July is extremely less. Currently, the target rate ranges between 425 to 450, while the chances to drop to 425 or 400 has reduced to only 4.7% today. The chance was 28.5% on 04th of June.

The uncertainty is on a constant rise, suggesting that a significant turn of events can be witnessed anytime.

Mercado bitcoin Teams up with Ripple to Tokenize $200M on XRP Ledger