Bitcoin’s $106K Max Pain Looms as $3.6B Crypto Options Expire – Brace for Impact

Today's crypto market faces a make-or-break moment as $3.6 billion in options contracts reach expiration—with Bitcoin's max pain price pinned at $106,000.

Market makers licking their chops as traders sweat bullets. The derivatives market's quarterly reckoning could trigger violent swings—just another day in crypto's casino economy.

Wall Street's usual playbook gets torched in this arena. No Fed put, no circuit breakers—just pure, uncut volatility. When the dust settles, someone's getting liquidated... and the house always wins.

$3.6 Billion in Bitcoin and Ethereum Options Expiry

Crypto options expiry typically brings a lot of volatility and sometimes a buy-the-dip opportunity, as in the present case. According to Deribit, over $3.6 billion in Bitcoin (BTC) and ethereum (ETH) weekly options expire today at 8:00 AM UTC.

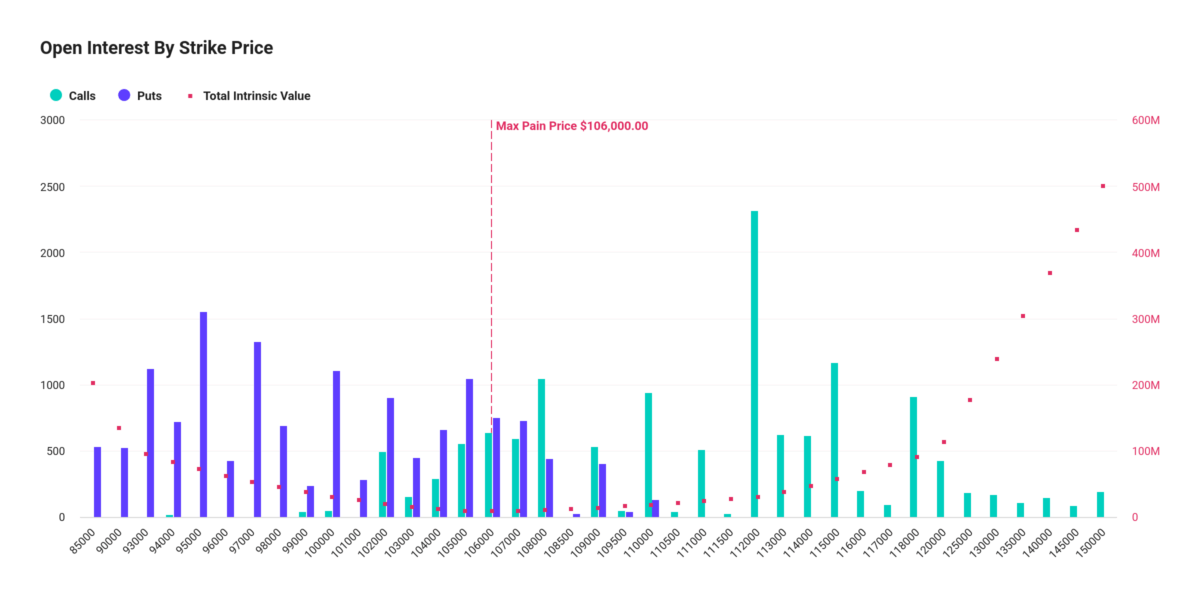

Over 27.5K BTC options with a notional value of $3 billion are set to expire. The max pain price is at $106K, giving market makers and traders room to bring down Bitcoin price to this level.

Moreover, the put-call ratio is higher at 1.06 at the time of writing. It suggests a bearish sentiment among traders as puts outpace calls. However, the put-call ratio is 0.54 in the last 24 hours.

As per Derbit, Today’s largest BTC block option trade was selling July-end 110,000 call options and buying 105,000 put options, totaling 600 BTC, earning a premium of $660,000. It WOULD be profitable if BTC’s price at expiry is below $112,000, a common hedging strategy during a strong bull market to protect current high returns.

Besides, 237K ETH options with a notional value of $0.6 billion are expiring today. Also, the max pain price is at $2,500, indicating that selling pressure could rise on ETH as traders exit or get liquidated.

Moreover, the put-call ratio is significantly higher at 1.26 at the time of writing. It suggests a bearish sentiment among traders as puts dominate calls. The put-call ratio is 0.49 in the last 24 hours.

Bitcoin Price and Ethereum Could Face Selling Pressure?

Typically, price moves to the max pain price before crypto options expiry, but it’s not observed in some cases. However, it accurately predicts the sentiment and price direction.

Bitcoin price has started to dip in the past 24 hours, with the price currently trading at $108,940. The 24-hour low and high are $108,811 and $110,541, respectively. Furthermore, the trading volume has decreased by 13% in the last 24 hours, indicating a decline in interest among traders.

In contrast, ethereum price pared earlier gains to fall nearly 2% in the last 24 hours. The 24-hour low and high are $2,553 and $2,635, respectively. Further, the trading volume in the past 24 hours has declined by 18%.

Also Read: Amber International Secures $25.5M to Buy XRP, BNB, SUI