🚀 Bitcoin Price Surge Imminent as MSTR Stock Shatters All-Time High!

MicroStrategy's relentless Bitcoin bet pays off—again. As MSTR stock hits record highs, crypto traders brace for what's next.

### The MSTR Effect: A Proxy for Bitcoin Mania

When Michael Saylor's tech-turned-crypto juggernaut rallies, Bitcoin rarely sits idle. Institutional FOMO meets retail euphoria—with predictable volatility.

### Wall Street's Worst-Kept Secret

Traditional finance still pretends to 'analyze fundamentals' while quietly tracking MSTR like a Bitcoin futures contract. The irony? They'll deny it over $500 martinis.

### What Comes After the ATH?

History says new peaks attract two things: profit-takers shaking weak hands, and true believers doubling down. Place your bets—the casino never closes.

Bitcoin ETF Records 14 Consecutive Days Of Inflow

As per the latest reading of SoSoValue, the BTC ETF has recorded only 3 negative trading days, while it has experienced 16 positive inflow days. Adding to this, with its positive trading day on 27th of June, it has recorded a 14-day inflow streak.

Notably, the highest inflow was recorded at $588.55 million on June 24, while the highest outflow was recorded on June 5 of $278.44 million. While this, the total netflow for the month of June concluded at +4,502.79 Bitcoins, making it another successful month for Bitcoin. Considering the market sentiments, let us now understand the short-term Bitcoin price prediction.

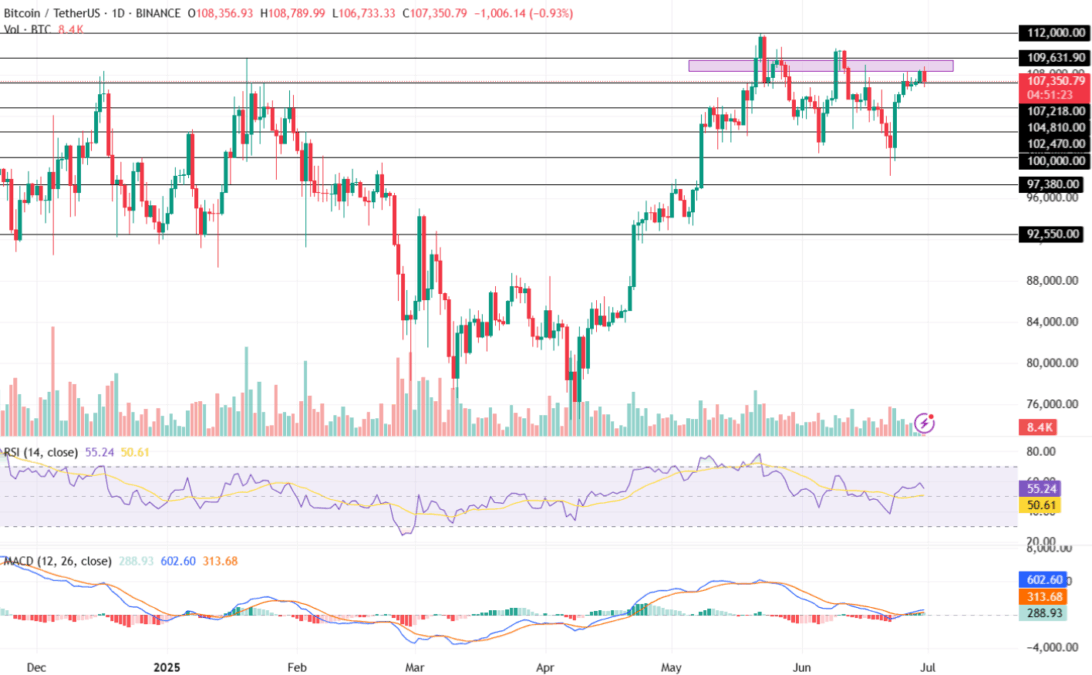

BTC Price Holds Its Major Support of $107,000

The bitcoin price has formed a strong resistance zone just below its watch point of $109,631 in the daily time frame, suggesting a strong selling point around that range. However, it has maintained its value above the $107,000 level, resulting in it recording a consolidated price action.

The RSI shows a drop and is valued at 55.24 (neutral) after recording a sideways action for a brief period, indicating a sudden increase in the selling pressure. Additionally, the average trendline hovers around the midpoint, indicating a weak bullish sentiment for the BTC price in the market.

The Moving Average Convergence Divergence (MACD) indicator records a fading trend in the green histogram as it is currently at 288.93. On the other hand, the 12 and 26-day averages are at 313.68 and 602.60, hinting at a rising negative action.

If the BTC price holds its value above its support of $107,218, this could result in it heading toward its upper price targets of $109,400 or $109,631 respectively. At that point, if the Bitcoin price rally intensifies, it may prepare to retest its ATH of $111,970 this month. On the flip side, bearish turnaround may pull the price of Bitcoin toward its low of $104,810 or important support of $102,470 within a short period.

Senator Lummis Raises Voice For Bitcoin Miners: Stop Double Tax