SBI Just Moved $703M in XRP—Is Ripple’s Partner Making a Power Play?

Ripple’s heavyweight ally SBI Holdings just shifted a jaw-dropping $703 million in XRP—triggering instant speculation. Was it a strategic liquidity move, or just another day in crypto’s wild west?

Why This Matters

When a financial giant like SBI—Ripple’s closest institutional partner—drops a nine-figure XRP transfer, markets notice. The transaction screams institutional confidence (or at least deep pockets).

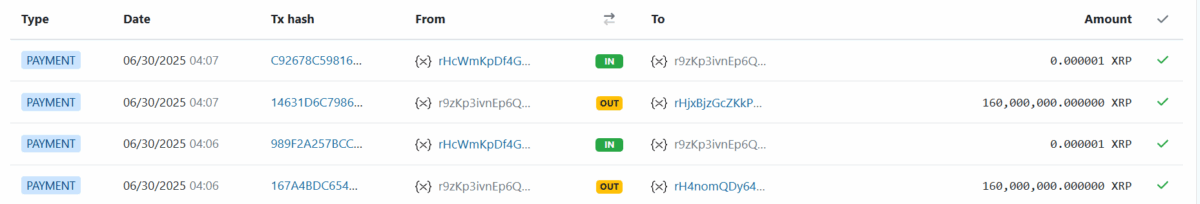

Behind the Numbers

$703M isn’t pocket change—even for Japan’s crypto-savvy megabanks. The move comes as XRP consolidates near key support levels, fueling theories about OTC deals or ecosystem funding.

Wall Street’s Crypto Paradox

Traditional finance still clutches its pearls over volatility—while quietly moving digital assets like this. Nothing says ‘mature market’ like nine-figure transactions that would give SEC lawyers heartburn.

As the transfer occurred outside Ripple’s scheduled escrow release, the XRP community associated the transfer with an upcoming big MOVE by SBI VC Trade.

Last week, Japan’s Financial Services Agency submitted a proposal to reclassify crypto as legitimate financial products, which paves the way for ETF launch. Also, the proposal included slashing Japan’s punitive crypto tax rate from as high as 55% to a flat 20%.

XRP price pared earlier gains and fell below $2.20. The 24-hour low and high were $2.18 and $2.22, respectively. Meanwhile, trading volume has increased by 15% in the last 24 hours, indicating a rise in interest among traders.

In the daily timeframe, the price is still below the 50-SMA, 100-SMA and 200-SMA at the time of writing. Whereas, the Relative Strength Index (RSI) slips slightly to 50.68.

Also Read: Ripple CEO Brad’s ‘1,000%’ XRP Commitment Goes Viral