Bitcoin Treasury Firms on the Brink: 2025 ’Death Spiral’ Looms

Hold onto your private keys—Bitcoin treasury firms are staring down a potential reckoning.

Market pressures, regulatory claws, and leveraged positions could trigger a domino effect next year. Here’s why 2025 might separate the HODLers from the bagholders.

The Perfect Storm

Illiquid reserves, overexposure to BTC-backed loans, and a single black swan event—sound familiar? Firms betting the treasury on Bitcoin’s volatility are playing with fire. And Wall Street’s watching with popcorn.

Survival of the Fittest

Only outfits with bulletproof balance sheets will weather the storm. The rest? A firesale of assets—and a masterclass in how not to manage crypto risk. (Cue the usual suspects blaming ‘market irrationality’ instead of their own leverage addiction.)

One thing’s certain: Darwinism doesn’t do bailouts.

Source: Breed

Source: Breed

Investors then see little upside in paying extra for shares backed by a falling asset, so fresh money, whether equity placements or convertible debt, dries up fast.

Capital is oxygen for these businesses. Many borrowed or raised cash precisely to buy more BTC, betting the coin WOULD climb faster than their financing costs. Should that oxygen run out while loans mature, lenders call in margins and force sales.

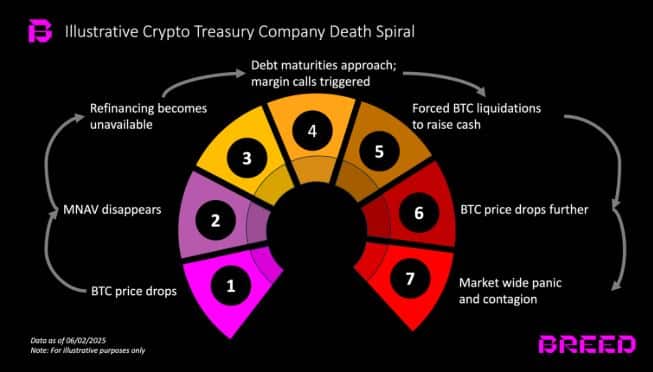

Each fire sale knocks the Bitcoin price lower, squeezing every other balance sheet in the same game. Breed labels that create a “death spiral.”

Right now, most treasuries still rely on equity funding, which cushions them from margin calls. But Breed warns the mood could flip if cheap debt tempts boards to lever up. A sector built on leverage would be far more brittle; one sharp price swing could push dozens of firms into compulsory liquidation at once.

Only a handful, Breed says, are likely to stay above water. The survivors will be the outfits that keep Bitcoin‑per‑share rising even in flat markets, communicate clearly, and refuse to chase unsustainable leverage. Strong governance and a cash buffer matter more than headline BTC totals.

The stakes are high. Since MicroStrategy opened the corporate‑treasury playbook in 2020, more than 250 organizations, from ETFs and listed miners to pension funds and even sovereign entities, have followed its lead, according to BitcoinTreasuries.net.

If 2025 brings the DEEP correction Breed fears, the metric that counts won’t be how many bitcoins a company once bought, but how many it can still hold when the dust settles.

Also Read: Michael Saylor’s bitcoin Strategy Sees $21B Profit