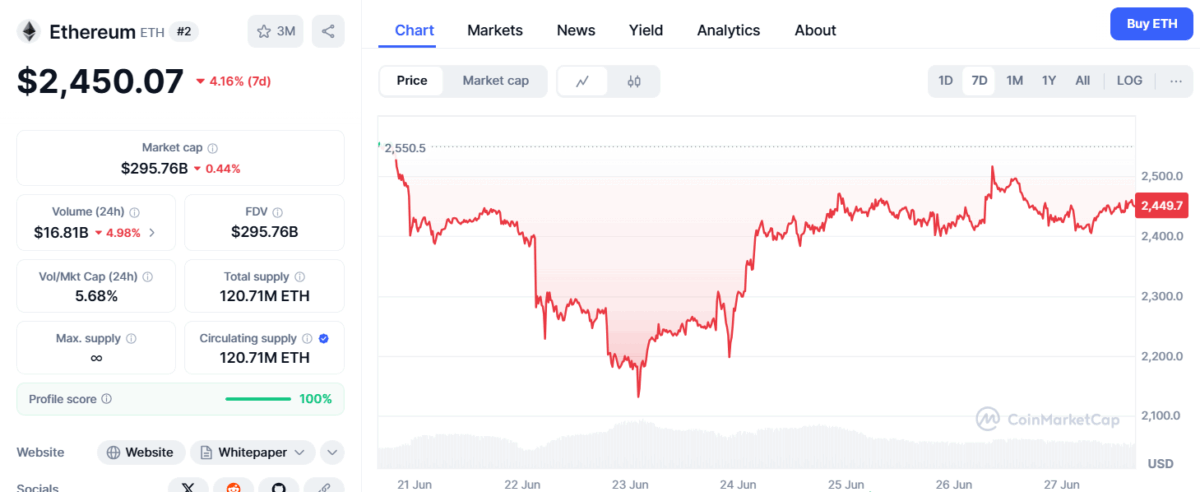

Ethereum Markets: Whales Gobble Up ETH Despite Surging Short Positions—Who’s Right?

Ethereum’s playing a high-stakes game of tug-of-war—and the ropes are on fire.

The Shorts vs. The Whales

While traders pile into record short positions betting against ETH, deep-pocketed 'whales' are buying the dip like it’s a Black Friday sale. Someone’s about to get burned.

Market Mechanics Gone Wild

Leveraged shorts hit historic highs this week, but blockchain wallets holding 10,000+ ETH keep expanding. Classic case of 'smart money vs. dumb money'—if you ignore the 90% of hedge funds that underperform Bitcoin.

What Comes Next?

Either we’re witnessing the mother of all squeezes brewing…or proof that even crypto’s elite occasionally enjoy lighting cash on fire for fun. Place your bets—the house always wins (and by house, we mean Coinbase’s trading desk).

Source: CoinMarketCap

Source: CoinMarketCap

As of now, the trajectory for ethereum price remains under pressure, but the interplay between retail shorting and whale buying could be pivotal. With increasing institutional buying and investors’ anticipation for new highs, ETH is expected to break above $2,500 and liquidate all those short traders.

Also read: XRP and Cardano (ADA) Remain Out of Grayscale’s Q3 Top 20 Crypto List