$17 Billion Crypto Showdown: Will Bitcoin and Ethereum Surge or Crash After Options Expiry?

Markets brace for seismic shifts as $17B in BTC and ETH options hit expiry—will bulls or bears dominate the aftermath?

Volatility ahead: Traders scramble to hedge positions before the Friday options bomb detonates. Open interest screams 'make or break' for both assets.

The gamma effect: Market makers' hedging strategies could amplify price swings—just when liquidity typically thins out. Perfect storm or buying opportunity?

Institutional poker face: Whale activity suggests some big players are loading up on cheap volatility. Others? Probably just rearranging deck chairs on the Titanic.

Post-expiry playbook: History shows 72-hour windows after major expiries deliver 20%+ moves. This time? The Fed's shadow looms larger than a Bitcoin maximalist's ego.

Over $17 Billion in Bitcoin and Ethereum Options to Expire

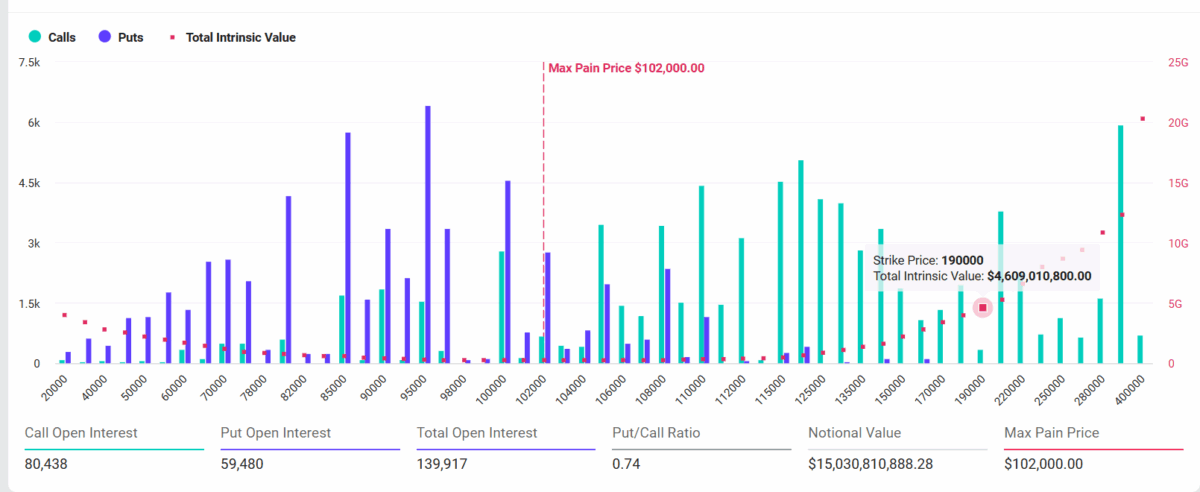

According to Deribit data, 139K BTC options with a notional value of more than $15 billion are set to expire on June 27. At the time of writing, the put-call ratio was 0.74, suggesting a slightly bearish sentiment among traders. Notably, it is the largest options expiry of the year and trades are cautious about it.

Moreover, the max pain point is at $102,000, indicating a high chance of correction in BTC price. Traders may adjust their positions, which can lead to increased volatility.

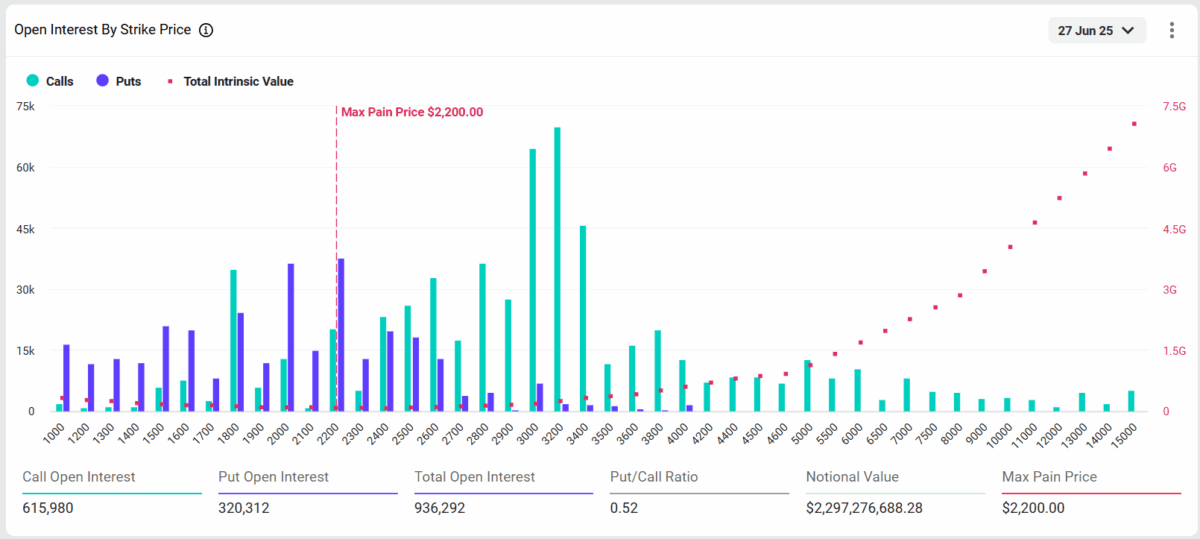

In contrast, 936K ETH options with a notional value of almost $2.3 billion are set to expire, with a put-call ratio of 0.52.

Also, the max pain point was $2,200 at the time of writing. Sentiment has turned slightly bearish for ethereum as evidenced by the put-call ratio of 0.95 in the last 24 hours.

BTC and ETH Prices May Fall

Traders also awaits U.S. Federal Reserve’s preferred inflation gauge US PCE data on June 27. Economists expect PCE inflation to come in hot 2.3%, up from 2.1% in the previous month.

Moreover, Fed Chair Jerome Powell maintained hawkish stance on monetary policy during the congressional testimony, implying a reluctance to cut rates due to US tariffs.

On-chain data by CryptoQuant signals risks selloff in Bitcoin price. The MVRV Ratio indicates slowdown in momentum, which means the bull market is entering the late stage.

Bitcoin Quickly Recovers from Geopolitical Tensions, But What About MVRV Momentum?

“Right now, that slope is flattening, suggesting a potential slowdown. This doesn’t mean a downtrend is imminent. But it could signal that we are entering the late stage.” – By @Yonsei_dent pic.twitter.com/D5QVopS6eE

BTC price action today was sideways to downside, with the price currently trading at $107,199. The 24-hour low and high are $106,817 and $108,305, respectively. Furthermore, the trading volume has decreased by 7% in the last 24 hours, indicating a decline in interest among traders.

Meanwhile, ETH price also pared earlier gains, with the price currently trading at $2,436. The 24-hour low and high are $2,399 and $2,519, respectively. Furthermore, the trading volume has increased by 13% in the last 24 hours, indicating a rise in interest among traders.

Traders should keep an eye on trading volumes and liquidation over the next 24 hours for cues on upcoming price direction.

Also Read: Metaplanet Tops Elon Musk’s Tesla With 12345 BTC, Now 7th Largest bitcoin Holder