Invesco & Galaxy Double Down on Solana ETF – SEC Filing Ignites Rally as SOL Price Faces Resistance

Wall Street's latest crypto gambit just went live. Invesco and Galaxy Digital fired the opening shot in the Solana ETF race today, dropping a fresh 19b-4 filing with the SEC that could rewrite the altcoin playbook.

The move comes as SOL struggles to break through key technical resistance—because what's a crypto narrative without some good old-fashioned price drama?

Behind the scenes: The filing reveals an institutional-grade custody framework that even SEC Chair Gensler might grudgingly approve. Galaxy's trading desk reportedly positioned SOL derivatives ahead of the announcement—because 'coincidental' timing is Wall Street's love language.

Market mechanics: While retail traders pile into SOL perpetuals, the real action's in the basis trade. Arbitrage desks are already licking their chops at the potential 15-20% spreads between spot and futures markets.

Closing thought: Nothing accelerates regulatory clarity like nine-figure Wall Street interests needing exit liquidity. The SEC's inbox just became Solana's most bullish chart pattern.

Source: SEC Archives

Source: SEC Archives

The proposed application is slated for listing on the Cboe BZX exchange under the ticker “QSOL,” and it will see BNY as the administrator and Coinbase as the custodian.

In this joint initiative, Invesco WOULD be the ETF sponsor, and the Bank of New York Mellon will be looking after administration. Meanwhile, Galaxy, as an asset manager, will be responsible for acquiring Solana (SOL) for the fund.

The appeal for Solana ETF lies in its high-speed blockchain infrastructure capable of processing up to 65,000 transactions per second, which is a stark contrast to Bitcoin’s slower network. The timing for this filing also coincides with a notable surge in Solana’s CME futures volume.

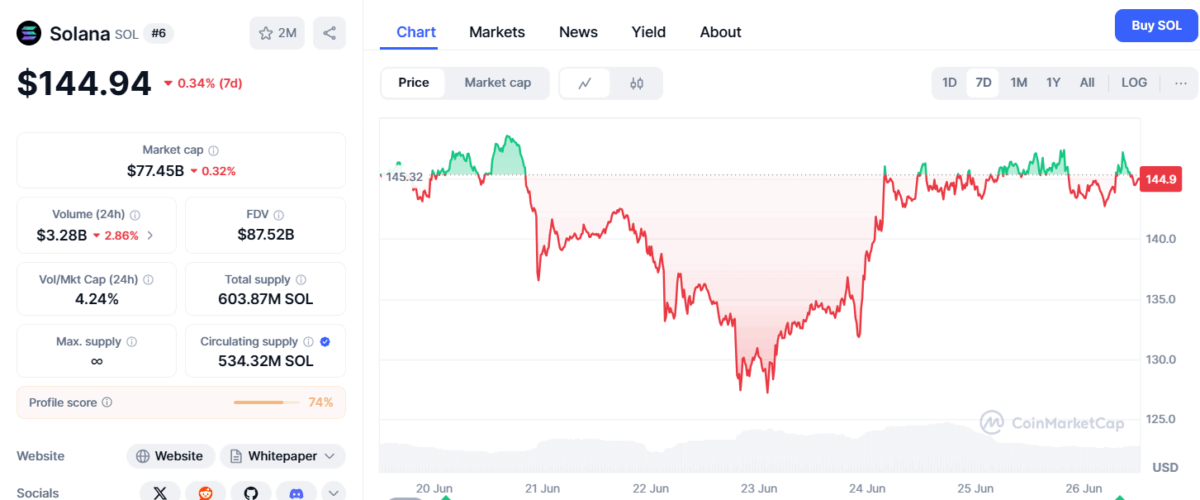

Impact on Solana (SOL) Price

Despite the news, the Solana (SOL) price has remained in a hurdle and continues trading in a weekly range, while traders were anticipating a major breakout. Historically, such ETF filings tend to push the underlying asset with sharp upsticks, but recently shifted market dynamics have altered the trend.

At the time of writing, Solana (SOL) is trading NEAR $144.94, having a 24-hour trading volume of $3.28 billion. Notably, SOL has declined over 16% in the past month, coinciding with a broader market downtrend.

Also read: BlackRock Pushes SEC to Approve XRP ETFs Before July: Fact Check