Bitcoin Exchange Balances Hit Historic Lows – Is a $111K Price Surge Imminent?

Exchange wallets are bleeding Bitcoin at record pace. The last time reserves were this thin, BTC rallied 300% in 90 days.

Supply shock incoming?

Whales are hoarding while retail traders chase meme coins. Classic.

Technical indicators scream 'oversold' as funding rates flip negative. When this happened in 2020, Bitcoin ripped to new ATHs within months.

Wall Street analysts suddenly remember their 'digital gold' PowerPoint slides. How convenient.

One thing's certain: the market's about to separate the HODLers from the leverage junkies. Place your bets.

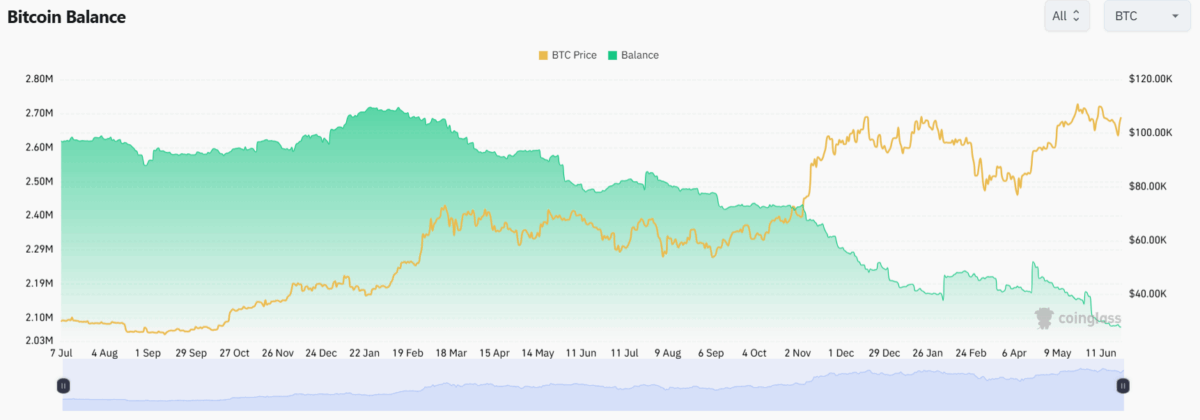

Bitcoin Exchange Balance Drops To New ATL Today

As per the data from Coinglass, the Bitcoin balance on exchanges have dropped to a new all-time low (ATL). Notably, the balance is now at 2.07 million with Coinbase pro holding the highest reserve of 638,226 BTCs, followed by Binance with 535,797 tokens.

Moreover, other 18 exchanges hold a collective total of approximately 895,270 Bitcoins. This shows rising accumulation of this token among the investors and whales.

BTC Price Jumps Over 8% in 72 Hours

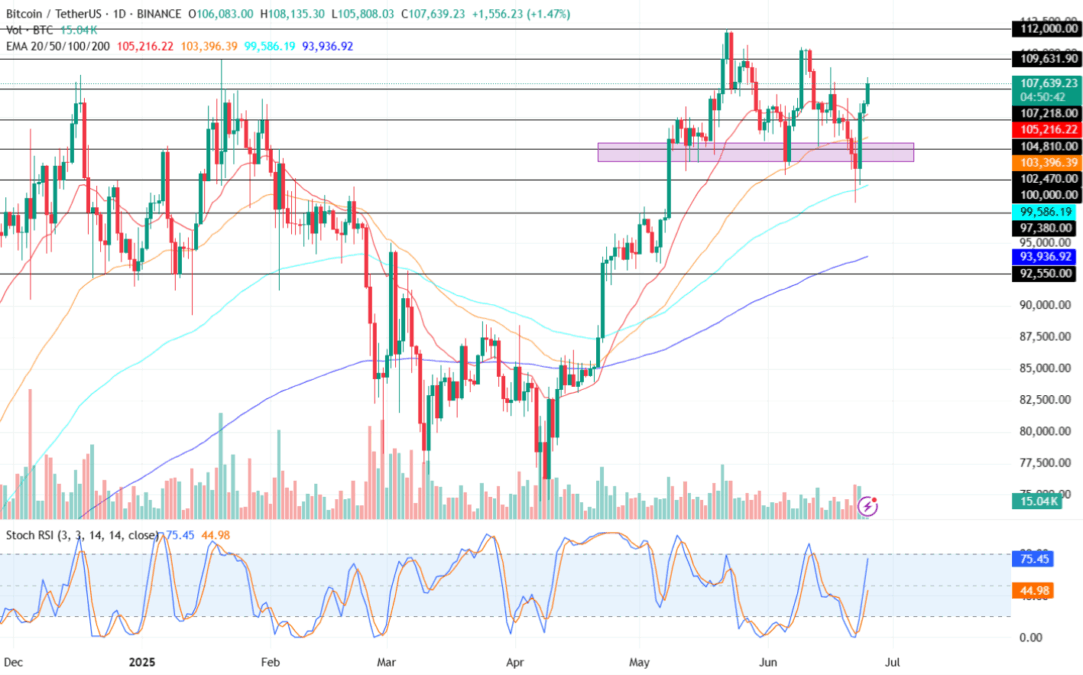

The bitcoin price has jumped over 8% in 72 hours, from $98,500 to over $107,500. Moreover, with an intraday trading volume of $51.98 billion, it is presently listed at $107,639. Following this, the market capitalization of it has increased to $2.14 trillion with a dominance of over 65% for the first time since 18th of January 2021.

The Exponential Moving Averages (EMAs) 20, 50, 100, 200 is an important indicator used by investors to determine the potential entry and exit points in the market. In this chart, all 4 EMAs are under the price trend, suggesting increasing volatility for the BTC price in the market.

The Stochastic RSI has displayed a strong upward trend in the daily time frame after successfully breaking out of its oversold (20) range. Moreover, with its 3-day average (blue) trendline on the verge of retesting its overbought (80) range. This shows a positive outlook for bitcoin this week.

A sustained bullish action could push the BTC price toward its resistance level of $109.631 or upper target price of $111,970 during the coming days.

On the contrary, a bearish reversal may pull the price of Bitcoin toward its immediate support trendline of $107,218 soon. Additionally, it could retest its lower support level of $104,810 if the bearish sentiment intensifies this week.

Tron Beats ethereum and Other Chains as USDT Supply Hits $80B