Circle’s Meteoric 750% Stock Surge Ignites Heated Stablecoin Debate

Stablecoin giant Circle just made Wall Street blink—its shares rocketed 750% in a move that's either genius or pure crypto delirium.

What's fueling the frenzy?

The market's betting big on Circle's USDC becoming the backbone of decentralized finance. But skeptics see another case of 'this time it's different' logic—remember when stablecoins were supposed to be boring?

One thing's clear: when a company tied to dollar-pegged tokens outperforms most tech IPOs, even traditional finance bros can't ignore the crypto circus anymore.

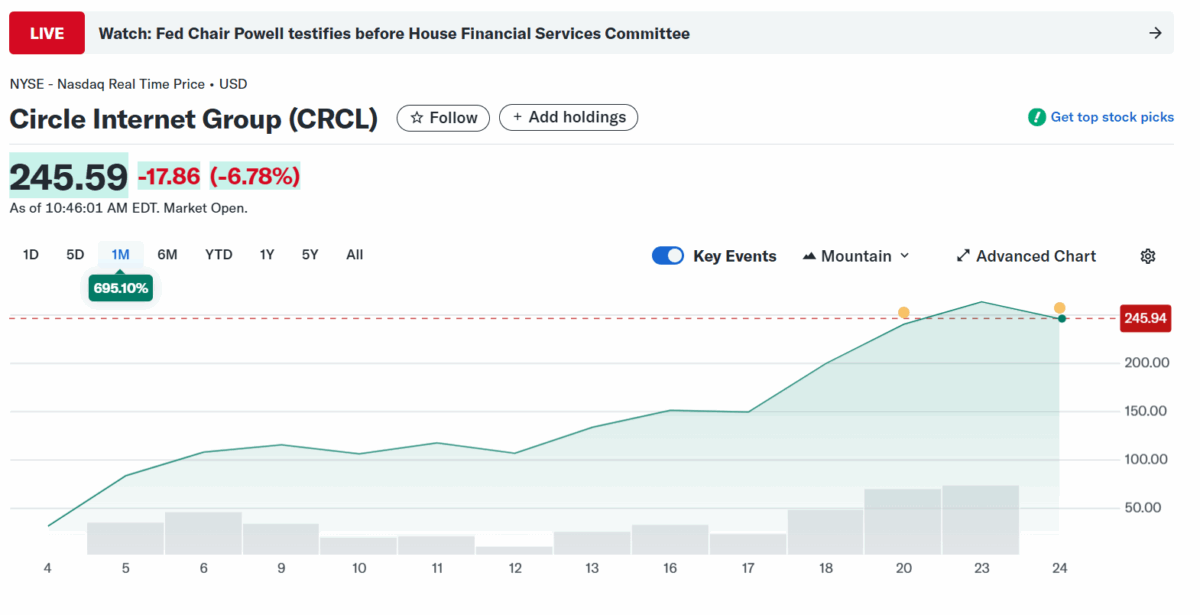

Circle Stock Chart since it started trading | Source: Yahoo Finance

Circle Stock Chart since it started trading | Source: Yahoo Finance

Meanwhile, this happened around the same time the U.S. Senate board passed the GENUIS Act bill to set rules for sablecoin. The stablecoin was a big win for the crypto space and for President Donald Trump, who also supports it.

The president is also linked to a stablecoin through a company called World Liberty Financial. That coin already has a value of about $2 billion. The House of Representatives is also working on its own version of this new law.

Because of all of this, other big companies are beginning to join the trend. According to a previous report, Fiserv, a tech company, announced it will launch its own digital coin (FIUSD), and it’s working with Circle and Paxos to make it happen. Mastercard has teamed up with Fiserv to bring stablecoins into its payment system. Even big names like Walmart and Amazon are thinking about creating their own coins.

This is all great news, but it has also caused problems for old-school payment companies like Visa, which are not moving as fast. With that, not everyone is impressed.

In a statement, Trevor Williams, a financial expert at Jefferies, said, “We are highly skeptical stablecoins will ever be a relevant payment method in the US.” He believes that people will stick with credit cards, which are easy to use and offer rewards. Another expert, Michael Lebowitz, said stablecoins are more like digital savings accounts for people who use crypto, not real competitors to Visa or Mastercard.

Aside from that, there are also some risks that are being pointed out. Experts say Circle’s stock has a low free float, only 25%, which means fewer shares are available for trading. That can make the stock jump more quickly, but also fall just as fast. Its price-to-earnings ratio is around 180, far above the S&P 500 average of 22, raising concerns about whether it’s overvalued.

Even so, Circle is moving forward. It’s building a new system to help banks send money across borders using USDC. Shopify will also start using USDC for payments around the world.

Also Read: Fidelity Adds $166M in Bitcoin, ethereum to Treasury Assets