Ark Invest Cashes Out: $110M Circle Share Dump After IPO Frenzy

Ark Invest just pulled the plug—hard. The Cathie Wood-led fund dumped $110 million worth of Circle shares mere days after its blockbuster IPO, leaving markets wondering if the stablecoin golden child has lost its luster.

The exit strategy: Ark’s move reeks of classic 'buy the rumor, sell the news'—locking in profits while the post-IPO confetti still littered the trading floor. No sentimental hodling here.

Circle’s reality check: The USDC issuer’s stock might’ve mooned on debut, but Ark’s sell-off hints at institutional jitters. Even stablecoins aren’t immune to Wall Street’s fickleness—especially when regulators lurk like tax auditors at a crypto beach party.

One thing’s clear: in TradFi’s casino, Ark just colored up its chips. Whether Circle’s long-term bet pays off? That’s a stablecoin peg even Tether might envy.

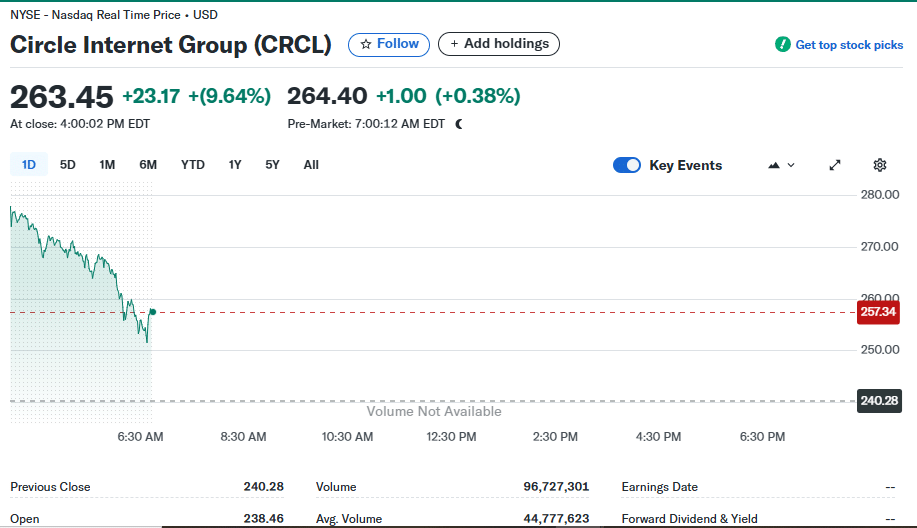

Source: Yahoo Finance

Source: Yahoo Finance

As of writing, CRCL closed at 263.45 on Monday.

Also Read: ARK Invest Sells $146M in Circle Stock After 675% IPO Surge