Litecoin Squeezed in $60-$100 Range as ETF Speculation Heats Up

Litecoin's playing hopscotch between $60 and $100—while Wall Street starts eyeing its ETF potential. Could this be the silver to Bitcoin's gold, or just another trader's short-term playground?

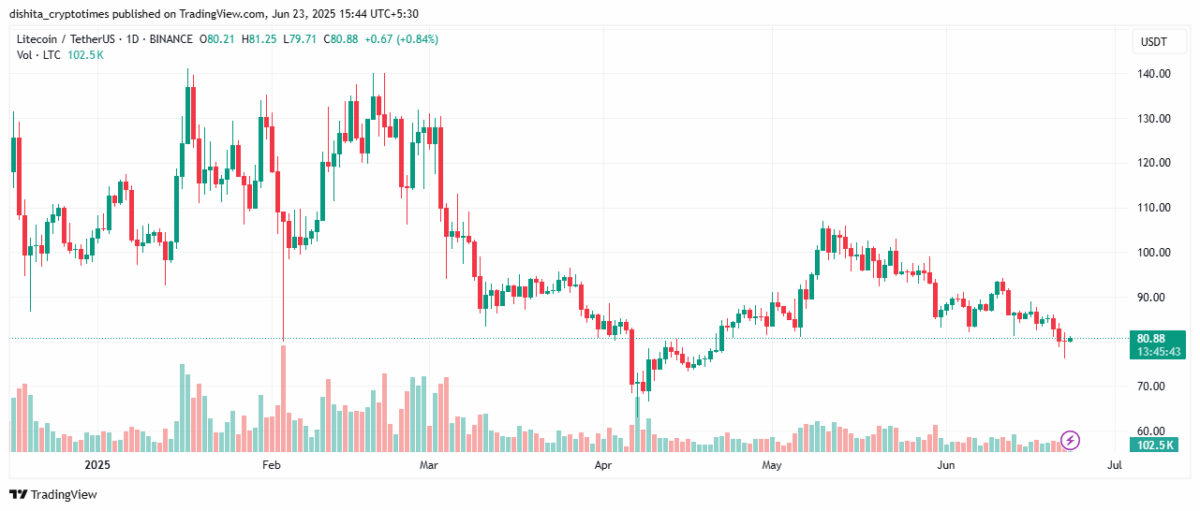

Price ping-pong continues

LTC's stuck in a 40-buck corridor, teasing breakout traders since... well, forever. The chart looks like a cardiogram for someone who just spotted a 'limited-time crypto offer.'

ETF dreams fuel the drama

Institutional whispers grow louder—because nothing gets money flowing like repackaging the same asset with a 2% management fee. The SEC's inbox must be 90% ETF applications and 10% 'How do I get my Bitcoin back?' emails.

What's next?

Either Litecoin breaks free and makes bagholders proud, or it becomes crypto's most persistent range-bound disappointment. Either way, the leveraged longs and shorts will keep the volatility interesting—until the next shiny regulatory distraction comes along.

Source: TradingView

Source: TradingView

Still, there’s a pulse. Trading volume has picked up sharply in the past day, jumping over 25% to reach $472 million. It’s not exactly a frenzy, but it’s enough to suggest that traders are watching closely. That $80 line? It’s more than technical support. It’s a psychological anchor, one Litecoin has bounced off in the past.

If it holds, bulls could push for a retest of the $100–$110 range, which acted as resistance earlier this year. Get past that, and the road opens up to $120, possibly even $140 again.

But if it cracks, and cracks hard, there’s little stopping a slide to $60 or even $50. A breakdown to $40 WOULD be brutal, but not unthinkable in a wider market correction.

What makes this moment especially interesting is the ETF chatter. Litecoin is quietly positioning itself as one of the next viable ETF candidates, right behind XRP. It’s been around for over a decade, has a fixed supply, and hasn’t been entangled in any major regulatory drama. That makes it a safer bet for institutions looking to diversify beyond Bitcoin and Ethereum.

Analysts are split. Some see this recent pullback as just another Litecoin cycle, calm before the storm. Others say the lack of clear momentum means any breakout, if it comes, will need real fuel: either ETF news or a shift in macro sentiment.

For now, the RSI is hovering just above 40, hinting at oversold conditions. Momentum indicators are still flashing red. There’s a whisper of a double bottom forming near $60, but it’s too early to call it confirmed.

Price projections vary wildly. Conservative estimates put Litecoin somewhere between $130 and $200 by the end of the year, assuming no ETF. But if regulators give the green light, those targets stretch as high as $700, lofty, yes, but not unheard of in crypto’s bull phases.

The bigger picture? Litecoin isn’t the trendiest coin in the room. It doesn’t have flashy DeFi apps or metaverse ambitions. But what it does have is history, reliability, and now, maybe, an ETF narrative picking up steam.

So while Litecoin sits quietly near $80, don’t mistake that for nothing happening. This might just be the calm before its next big move.

Also Read: ethereum price Bounces from $2,100; Hints Towards New Highs