Institutions Go Bargain Hunting: BTC, ETH, SOL, and XRP See Massive Inflows Amid Market Panic

Wall Street's whales are buying the dip—while retail traders hyperventilate into paper bags.

The smart money moves: Institutional inflows surged this week across Bitcoin, Ethereum, Solana, and Ripple's token despite blood-red charts. Seems the suits learned something from 2022's crypto winter.

Contrarian playbook: While Twitter doomscrolls about 'crypto is dead' (again), cold wallets linked to hedge funds and family offices show seven-figure accumulations. Nothing like a 20% fire sale to get financiers interested—where was this enthusiasm at all-time highs?

The cynical take: Of course they're loading up now. After skimming profits from the last bull run, institutions need cheap inventory for when they pump the 2026 'Web3 Renaissance' narrative to your aunt's retirement fund.

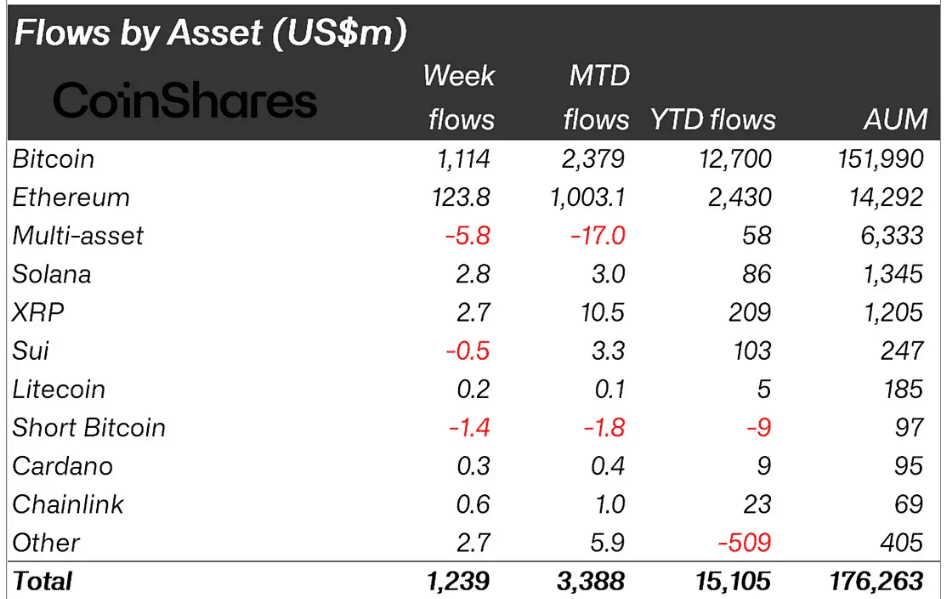

Crypto Funds Flow. Source: CoinShares

Crypto Funds Flow. Source: CoinShares

Bitcoin saw $1.1 billion in inflows, indicating investors were buying on weakness. BTC recently recovered after recording sell-offs for two consecutive weeks despite the Israel-Iran conflict. Minor outflows of $1.4 million from short-Bitcoin products further support the bullish sentiment.

Ethereum (ETH) maintained its positive momentum for the 9th consecutive week, with $124 million in inflows. According to the report, this marks the longest run of inflows since mid-2021.

Institutional demand for solana (SOL) and XRP also continued for another week, with $2.78 million and $2.69 million in inflow, respectively. The buying continues as Bloomberg updates approval odds to 95% for spot Solana and XRP ETFs amid positive developments from the US SEC.

As per the report, institutional investors were largely bullish in the United States. Spot Bitcoin and ethereum ETFs, along with other funds, saw a net inflow of $1.25 billion.

Experts such as Arthur Hayes, Mike Novogratz, and Eric Balchunas also remained bullish despite the US involvement in the Israel-Iran conflict.

Also Read: ethereum price Bounces from $2,100; Hints Towards New Highs