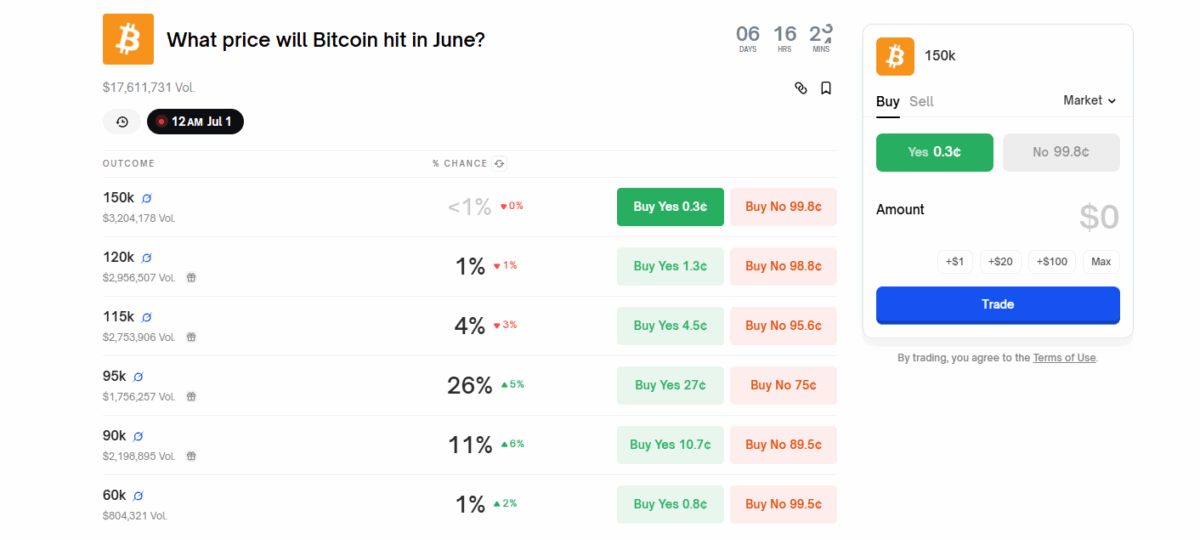

Will Bitcoin Plunge Below $95K in June? Polymarket Bets Show 38% Odds

Bitcoin's bull run faces a critical test this month as prediction markets flash warning signs. Polymarket traders now price a 38% chance of BTC dipping under $95,000—a psychological threshold that could trigger cascading liquidations.

The volatility paradox strikes again

While institutional inflows hit record highs, derivatives markets show growing skittishness. The $95K support level has become this cycle's make-or-break zone—where overleveraged longs meet profit-taking whales.

Greed and fear in perfect harmony

Options traders keep stacking bullish bets for Q3, creating a bizarre disconnect from spot market jitters. Typical Wall Street behavior—hedging against the very rally they're fueling.

Whether this proves a healthy correction or the start of something uglier depends on one thing: how fast the 'weak hands' fold when their 100x leverage gets vaporized.

Source: Polymarket

Source: Polymarket

While it’s roughly a week on resolving these bets, this marks a renewed interest in lower targets as bitcoin sees a drastic drop on Sunday evening.

At the time of writing, Bitcoin is hovering NEAR $102K—down 4.38% in the past 7 days. It is trading below all EMA 20/50/100/200, while dipping as low as $98,240 in the latest downtrend—as per market data from TradingView.

The recent drops in Bitcoin and eventually the whole crypto market are attributed to the increased geopolitical tension between Israel and Iran. Moreover, the entrance of the United States into the conflicts has made the situation even more tense.

Also read: Metaplanet Buys the Bitcoin Dip, Total Holdings Reach 11,111 BTC