Wall Street Warns: A Bitcoin Crash Could Obliterate Michael Saylor’s High-Stakes Strategy

Michael Saylor’s billion-dollar Bitcoin gamble faces a brutal stress test as analysts sound the alarm.

### The MicroStrategy House of Cards?

Wall Street’s sharp suits claim Saylor’s leveraged BTC play—once hailed as visionary—could implode if crypto winter returns. The company’s entire treasury strategy now hinges on an asset known for 80% drawdowns.

### When Hodling Becomes a Liability

MicroStrategy’s 214,000 BTC stash looks less like innovation and more like recklessness when priced in red ink. ‘Diamond hands’ work until they don’t—just ask Celsius investors.

### The Institutional Paradox

Irony alert: the same analysts who mocked Bitcoin now weaponize volatility fears against its most vocal corporate champion. Meanwhile, BlackRock quietly stacks SATs behind closed doors.

Finance never changes—only the narratives do. And right now, Wall Street’s betting against the guy who bet it all on orange coin.

How Bitcoin Price Crash Can Bring Doom to Strategy

It started when Jim Chanos reacted to a posted video on June 19, where Saylor claimed that the company’s debt is not a risk, even if bitcoin crashes. In the video, Saylor said, “It’s not debt, it’s convertible debt. It is unsecured, no recourse. What that means is that Bitcoin could go from $100K to $1K. The debt’s not getting called. There’s no recourse.” He also said that the company could pay the debt in stock instead of cash, even if Bitcoin dropped 75%.

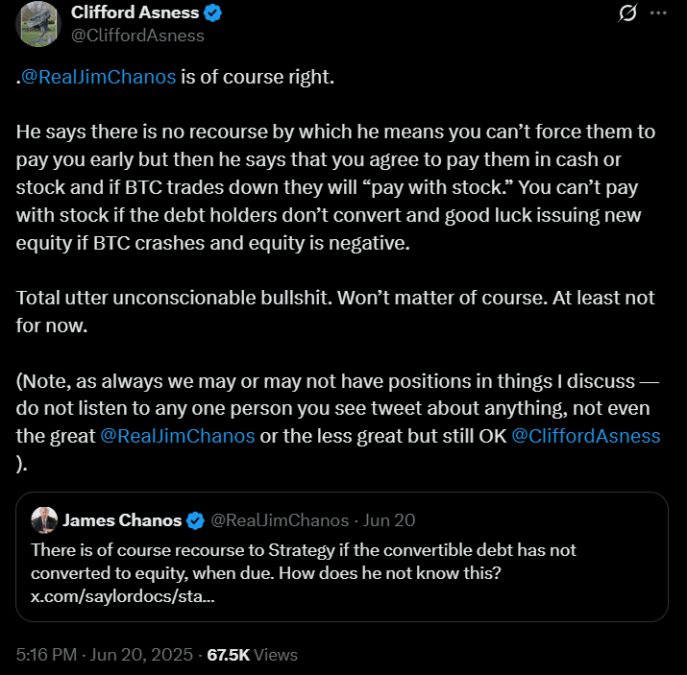

Chanos strongly disagreed with this: “There is of course recourse to Strategy if the convertible debt has not converted to equity, when due. How does he not know this?” He tweeted. Chanos believes the company is still responsible for paying the debt when it’s due, no matter what.

Cliff Asness jumped in to back Chanos. He posted, “@RealJimChanos is of course right.” He explained that paying back with stock isn’t always possible. He wrote, “You can’t pay with stock if the debt holders don’t convert and good luck issuing new equity if BTC crashes and equity is negative.” He also called Saylor’s logic “Total utter unconscionable bullshit.”

Asness made it clear that he’s fed up with what he sees as unrealistic thinking in the crypto world. He also reminded his followers not to blindly believe anyone online. “Do not listen to any one person you see tweet about anything,” he added.

Chanos has often described himself as “not a fan” of cryptocurrency in the past, even though he

has been reportedly shorting Strategy’s stock while buying Bitcoin directly. He has even called strong Bitcoin supporters “Ponzi cultists” in the past as well.

He believes that while Bitcoin may have value, Strategy’s stock is too expensive and doesn’t reflect the true value of the Bitcoin it holds. In a recent interview with Bloomberg, he said the company’s financial model is “gibberish.”

Strategy’s stock has gained 27% this year and has gone up over 3,000% since 2020, when Saylor first started buying Bitcoin for the company.

Also Read: Solana’s “MicroStrategy” SOL Strategies Files to Trade on Nasdaq