Ethereum Whale Rakes in $20M Crypto Windfall—Proving DeFi Still Prints Money

Move over, Wall Street—crypto's new money is minting fortunes faster than hedge funds can file their SEC paperwork. One trader just turned Ethereum into a personal ATM, cashing out $20 million in pure profit during June 2025's market surge.

How? Probably by doing the opposite of whatever your financial advisor recommended.

The playbook: Spotting Ethereum's liquidity patterns before the crowd, leveraging decentralized protocols like a Vegas high-roller, and exiting before the inevitable 'wen lambo' tweets flooded Crypto Twitter. Meanwhile, traditional investors were still waiting for their wire transfers to clear.

Love it or hate it—this is what alpha looks like in the age of internet money. Just don't ask about the tax bill.

Source: Hyperdash

Source: Hyperdash

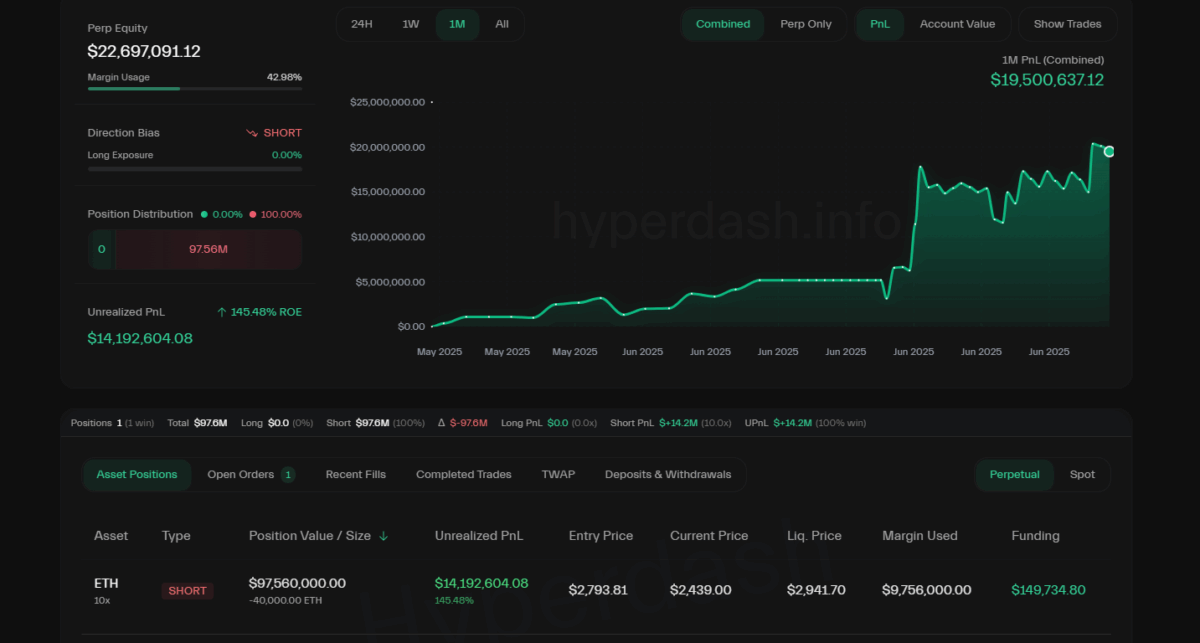

This trader is currently holding a $97 million short position on Ethereum (ETH) with a profit of $14.8 million, the trade of which coincides with Friday’s dip from $2,560 to a current price of $2,382 in a colossal sell-off.

Notably, the trader has executed only 3 trades this month, which all netted $2.66 million (short) on 6 June, $1.62 million (long) on 5 June, and $1.116 million (long) on 23 May. These profits underscore the trader’s ability to anticipate market shifts and stay ahead of the curve.

The success of this trader challenges the perception of crypto trading as speculative gambling. While some users on X hail the trader as a “beast from the future,” others caution that such success requires years of experience, not mere imitation.

Also read: Veteran Trader Peter Brandt Gives Golden Advice As Bitcoin Nears ATH