Bitcoin Price War: Analysts Clash as Friday Sell-Off Resets Market Psychology

Market divisions deepen as Bitcoin's latest volatility sparks fresh debate.

Bull vs. Bear: The Great Crypto Divide

Friday's 10% price dump wasn't just a correction—it was a reality check for overleveraged traders. While permabulls point to 'healthy consolidation,' skeptics see warning signs in the order books. Neither camp denies the timing: summer liquidity crunches always separate the diamond hands from the weak.

Whales vs. Minnows: Who's Really Driving the Action?

On-chain data reveals institutional accumulation beneath retail panic. Smart money's playing chess while day traders play checkers—again. Exchanges reported triple the usual BTC withdrawals post-dump, suggesting either brilliant contrarian plays or another round of 'buy high, sell low' genius from the Robinhood crowd.

The Cynic's Corner: Wall Street Still Doesn't Get It

Traditional analysts keep framing crypto volatility as 'risk' rather than opportunity. Meanwhile, Bitcoin's 180% year-to-date gain quietly outperforms every asset class they recommend—but sure, keep chasing those 5% bond yields.

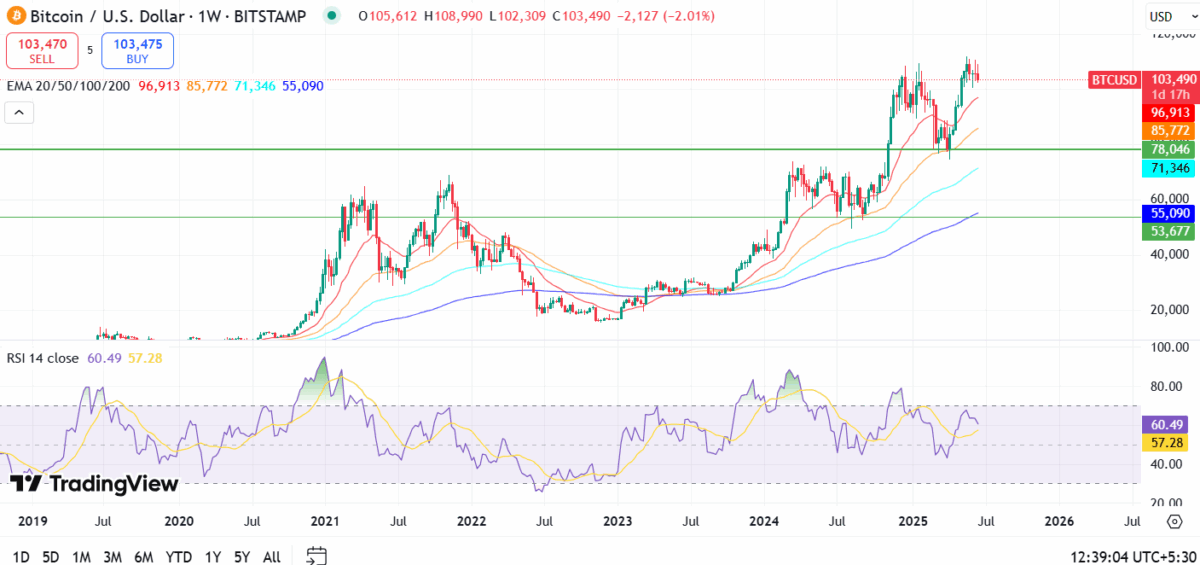

Source: TradingView

Source: TradingView

The Crypto Fear & Greed Index, updated recently, hovers in the “Neutral” zone, reflecting investor caution after the Friday dump.

Industry experts caution that Bitcoin’s volatility, historically driven by sentiment and trading volume, could likely amplify a downtrend. However, a strong long-term cointegration between Bitcoin’s price and trade volume might sustain buying pressure and propel further gains—given that the current uncertainty resolves in favor of optimism.

As the weekend unfolds, traders are closely monitoring key support levels around $100K–$102K for the Bitcoin price, with many eyeing the next breakout as a litmus test for recent predictions. For now, the market remains a battleground of hope and hesitation, with Bitcoin’s next MOVE hanging in the balance.

Also read: CoinMarketCap Confirms Removal of Malicious Wallet Scam Popup