Bitcoin Dips 4% to $103K as Iran-Israel Conflict Rattles Markets—Buy the Fear?

Geopolitical shockwaves hit crypto as Bitcoin sheds $103K support. Middle East tensions trigger classic flight-to-safety moves—but smart money knows these dips never last.

When missiles fly, algorithms panic. Today''s 4% drop reeks of overleveraged traders getting liquidated, not fundamental weakness. Remember: Bitcoin survived nuclear war threats in 2022—this is just another blip.

Meanwhile, Wall Street''s ''risk-off'' brigade will pretend they saw it coming. Spoiler: They didn''t. Their gold positions just needed a headline to justify underperforming crypto again.

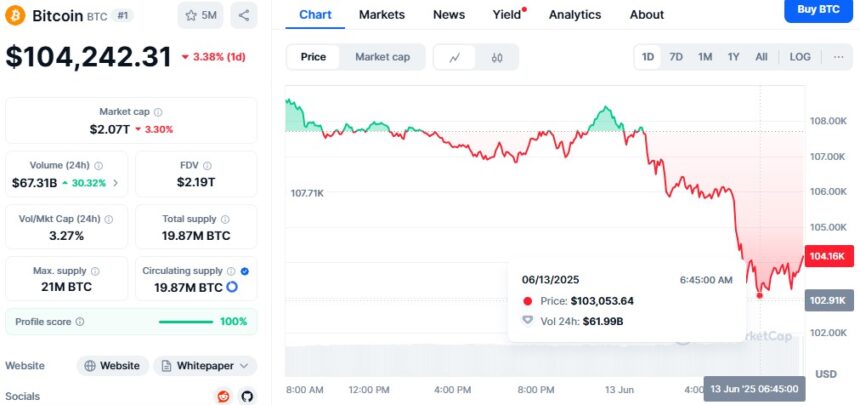

Bitcoin (BTC) Price Crash – Source: CoinMarketCap

Bitcoin (BTC) Price Crash – Source: CoinMarketCap

According to researcher Axel Adler Jr., this MOVE was a soft reversal point, driven by profit-taking at resistance levels and more short positions. He remarked that funding is still positive, yet open interest is declining, typically indicative of short-term correctional activity or sideways movement around $108K.

But fractal analysis is hinting at something more ominous in the making. This current price behaviour is reflective of a structure in January 2025, where bitcoin moved up and down in a comparable manner.

The chart now displays that BTC is unable to surpass its prior all-time high, and the RSI has reached a resistance level of 60 after dropping below 50, a phenomenon that may indicate a more significant drawdown.

Should this fractal play out, we could see Bitcoin revisit the $100K mark that is well supported in terms of liquidity. A decline below Monday’s low of $105K WOULD confirm the bearish configuration.

Conversely, should BTC retake and sustain above $108K, then the fears of a bull trap will be nullified, and a resumption of the bullish momentum may be indicated. In the meantime, investors are hesitant as Bitcoin is hanging in a critical area.

Also Read: Bitcoin price Braces for Impact as US PPI Rises to 2.6%