Bitcoin on Edge: US PPI Spike to 2.6% Threatens Crypto Markets

Brace for turbulence—Bitcoin''s price faces a critical test as US Producer Price Index (PPI) inflation surges to 2.6%. The crypto market''s next move hinges on whether traders see this as a blip or the start of a macro storm.

Why PPI matters more than ever

Unlike consumer inflation, PPI measures wholesale price pressures—the kind that eventually trickle down to Main Street. When producers pay more, consumers eventually do too. And for Bitcoin? That means renewed Fed hawkishness could strangle the liquidity that crypto thrives on.

The institutional tug-of-war

While retail traders panic-sell at every inflation headline, whales are watching the long game. Some see Bitcoin''s 2024 supply halving as the ultimate inflation hedge—even if Wall Street still pretends gold is relevant.

Bottom line: Bitcoin doesn''t care about your inflation models. It''ll moon or crash based on whether the Fed blinks—and whether institutions finally admit fiat is broken. (Spoiler: they won''t.)

Bitcoin Price Forms Bearish Action

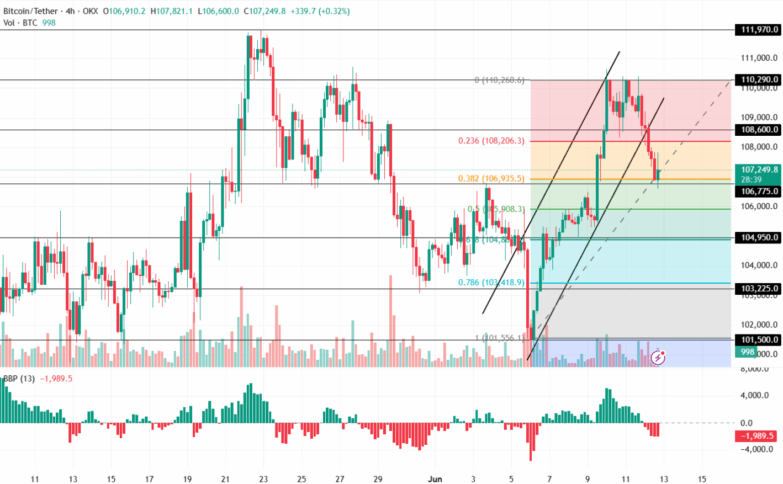

The Volume indicator shows lower volumes, suggesting weak price action for the crypto token. This indicator plays a vital role while analysing the price prediction of a project as it accurately shows the trading volume which can be used to determine the possibility of a breakout, breakdown, or a trend action.

The Bear Bull Power (BBP) after its recent price surge showed a fading green histogram and has turned negative recently. It signals an increasing bearish influence in the market for the token.

The Fibonacci retracement for this chart has been drawn between $101,556 as its low and $110,268 as its high. Considering the chart, the key levels for a potential reversal are 0.236, 0.382, 0.50, 0.618, and 0.786, respectively. The key watch zone is 0.382 as it is the moderate support zone during a pullback situation.

Will BTC Price Rise Back Up?

If a bullish reversal occurs, the Bitcoin token could retest its 0.236 ($108,206) level. A sustained positive action could result in it heading toward its upper price range of $110,260 in the upcoming time.

However, a negative price sentiment could result in it retesting its lower support levels. A breakdown could lead the bitcoin price toward its 0.5 level ($105,908) or 0.618 ($104,818) respectively in the upcoming time.

Also Read: ethereum Tops Bitcoin in Another Metric: Derivatives Volume Hits $114B