Ethereum Smashes Through $2,700—Is $3,000 the Next Stop?

Ethereum just bulldozed past $2,700, leaving traders scrambling and bulls drooling. The question on everyone’s lips: Can it crack $3,000 before Wall Street 'discovers' crypto again—only to panic-sell at the first dip?

No fancy jargon here—just pure momentum. ETH’s rally isn’t just a fluke; it’s a middle finger to the 'crypto is dead' crowd. But let’s see how long the suits stay interested before they pivot back to overpriced AI stocks.

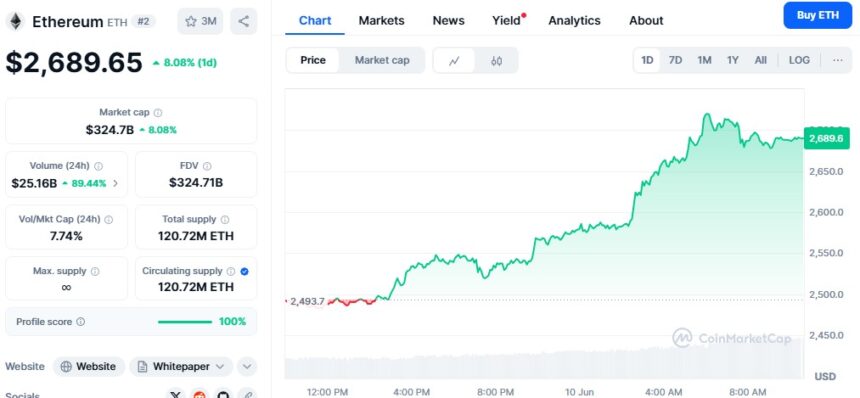

Ethereum Price Jump– Source: CoinMarketCap

Ethereum Price Jump– Source: CoinMarketCap

Institutional investors are also becoming more active. BlackRock’s iShares ethereum Trust (ETHA) has not experienced any outflows for 23 consecutive trading days.

The firm has also added $500 million in ETH, which now brings its total holdings to 1.5 million ETH worth $2.71 billion. Meanwhile, ETFs based on Ethereum are still receiving investments, as they brought in $296 million last week.

Technical charts also suggest that the market is headed up. Ethereum has broken above the midline of the Gaussian Channel and a bullish divergence is forming, which is a sign that followed big rallies in 2020 and 2023. If the current trend continues, analysts are expecting the price to increase to $3,100–$3,600.

Even so, $2,700–$2,800 is an important level for Bitcoin to overcome. If a major breakout happens, it could cause a rally in the altcoin sector. If ETH cannot maintain this level, it could drop down to the $2,400–$2,500 support zone again.

The price of Ethereum is still not as high as it was before, so it is attractive to investors who want to buy and hold or trade in the short term. A solid foundation and more trust in the market may be preparing ETH for another major shift in the crypto world.

Also Read: SEC Continued Probing Ethereum Even After ETH ETF Approval: Coinbase