Hoskinson Declares Cardano the Beating Heart of Bitcoin DeFi

Cardano isn't just playing in the DeFi sandbox—it's building the castle. Founder Charles Hoskinson positions the blockchain as the critical bridge between Bitcoin's legacy and decentralized finance's future.

No vague promises here—just a direct challenge to Ethereum's dominance. With Bitcoin's liquidity and Cardano's proof-of-stake efficiency, the combo could rewrite DeFi's rules. Assuming, of course, the institutional money doesn't get cold feet—again.

One thing's clear: if Hoskinson's vision hits, even the Wall Street suits might have to admit crypto's more than just monkey JPEGs and memecoins.

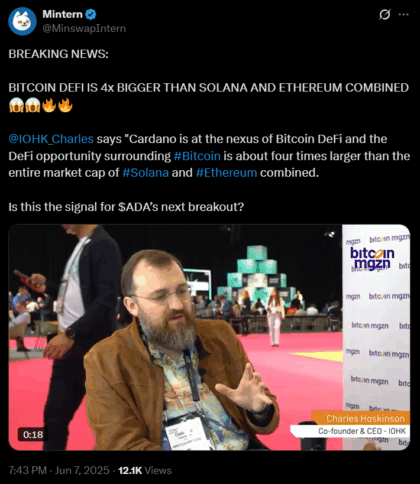

Hoskinson said Cardano is at the center of Bitcoin DeFi | Source: X

Hoskinson said Cardano is at the center of Bitcoin DeFi | Source: X

Hoskinson described Bitcoin as a “giant sleeping monstrosity,” saying its DeFi opportunity is about four times bigger than the entire market cap of Solana. In short, Hoskinson wants cardano to lead the charge in building Bitcoin DeFi on its platform.

“When we look at the DeFi markets, it’s mostly a Solana, Ethereum type of a circle, and we have a little bit of DeFi and others do as well, but that’s really where the center of gravity is,” Hoskinson explained.

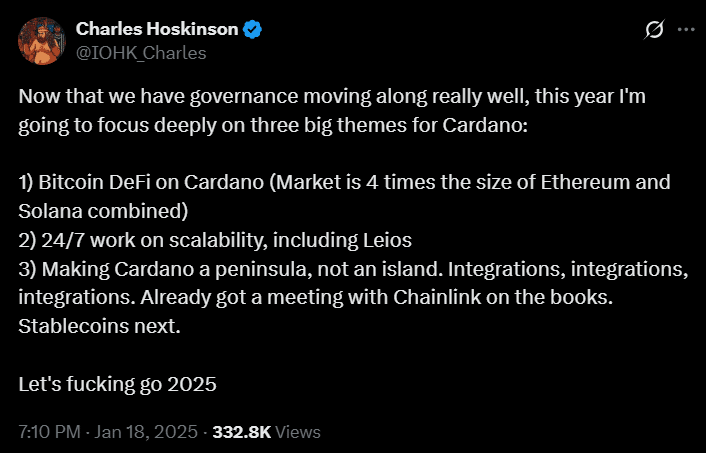

Hoskinson talked about this plan in a tweet in January 2025. He listed three main goals for Cardano this year. The first was focused on bitcoin DeFi, then improving scalability with a new protocol called Ouroboros Leios, and additional connections to other projects like Chainlink.

He said, “Now that we have governance moving along really well, this year I’m going to focus deeply on three big themes for Cardano.”

DeFi, or decentralized finance, first took off on Ethereum and grew rapidly on Solana, which currently holds around $111.3 billion in total value locked (TVL), according to DefiLlama.

Ethereum’s DeFi TVL is the largest at approximately $61.2 billion. But Hoskinson believes the Bitcoin DeFi market is much larger and more promising. His goal is to unlock this potential on Cardano.

Also Read: Nasdaq Adds XRP, SOL, ADA, XLM to crypto Index