BlackRock Goes Big on Ethereum: $500M Coinbase Spree in Just 10 Days

Wall Street’s quiet crypto accumulation just got loud. Arkham data reveals BlackRock dropped half a billion on ETH—faster than a hedge fund liquidating a startup.

The Institutional Stampede

No slow DCA here. The world’s largest asset manager vacuumed up Ethereum while retail traders were still checking gas fees. Coinbase’s order books got a $500M workout in under two weeks.

Crypto’s New Market-Makers

Forget ‘number go up’—this is ‘balance sheet go brrr.’ Traditional finance isn’t dipping toes anymore; it’s doing cannonballs into the deep end of DeFi pools. (Bonus irony: the same firms that called crypto a scam now trade it like a forex pair.)

One question remains: when BlackRock sneezes, does the entire altcoin market catch a cold?

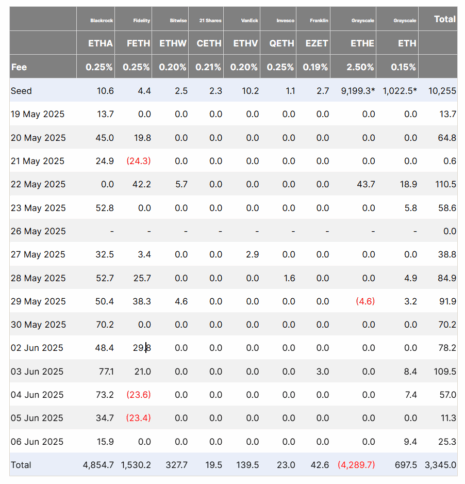

ETH ETH FLOW | Source: Farside Investor

ETH ETH FLOW | Source: Farside Investor

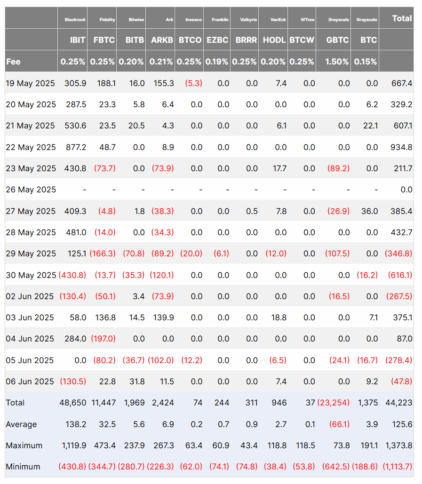

At the same time, spot Bitcoin ETFs are seeing money flow out. In the same 10-day stretch, Bitcoin ETFs recorded $278.4 million in outflows on June 5 alone, led by ARk investment and major withdrawals from Fidelity, Bitwise, and Grayscale. Over the two weeks, total net inflows into Bitcoin ETFs added up to $44.2 billion, but recent days show a clear slowdown, with multiple firms logging consistent red days.

BlackRock CEO Larry Fink shared his thoughts on Ethereum’s potential in a statement. He believes the role of Ethereum and blockchain technology can grow dramatically if there is more acceptability, transparency, and better analytics related to these assets.

According to Fink, growth is not mainly about more or less regulation but depends on liquidity, transparency, and improved data. “I think its a function of liquidity, transparency, and then to that process no different than years ago.”

He compared this process to the early days of the mortgage and high-yield markets, which started slowly but expanded as better analytics and market acceptance developed. “I truly believe we will see a broadening of the market of these digital assets,” Fink said

What’s Ahead for Ethereum?

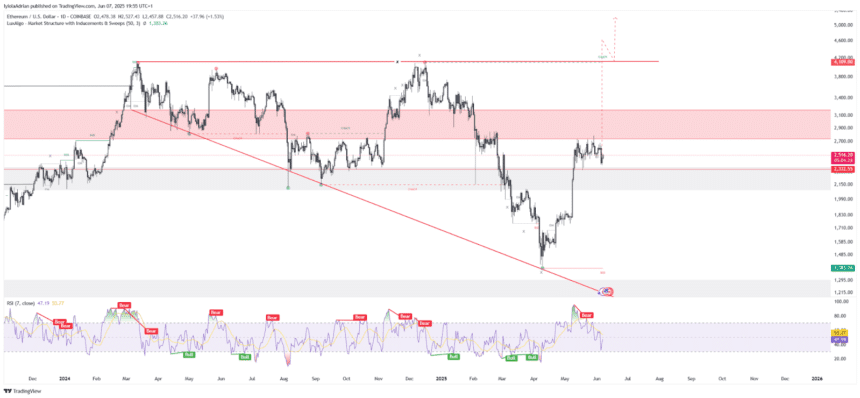

Ethereum’s price jumped from $1,790 to above $2,700 over the past month. This is a 54% increase. it’s showing signs of a breakout.

Currently, the token is forming a pattern called a “Right-Angled Descending Broadening Wedge,” which in past cases has led to big price moves.

As of June 7, Ethereum is trading for $2,516, according to CoinMarketCap. It dipped briefly during a recent market drama involving Elon Musk and Donald TRUMP but quickly recovered.

Also Read: ETH Season Heats-up: Weekly ETF Inflows in Ethereum Outshines Bitcoin