Ethereum Traders Bleed $310M in Two Days—Is ETH Headed for a Cliff?

Another bloodbath in crypto land—Ethereum traders just got steamrolled for $310 million in 48 hours. The question isn't 'if' but 'how hard' the market will punish weak hands.

Short-term pain, long-term game? ETH's price swings have turned into a high-stakes poker match. Bulls cling to the 'accumulation phase' narrative, while bears sharpen their knives. Classic crypto theater.

Meanwhile, institutional sharks circle—because nothing screams 'hedge against volatility' like dumping retail bags during a fire sale. Stay greedy, folks.

Ethereum On-chain Analysis & ETH Price Prediction

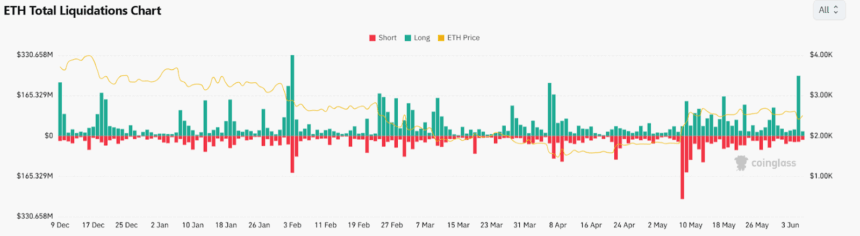

As per the reports of Coinglass, yesterday, the ethereum token has experienced its single highest liquidation for the first time since February 3, 2025. ETH traders lost $24.43 million in shorts, whereas $245.685 in long positions. Comparing it with 3rd, it had lost $151.30 million in short alone and $330.658 million in long positions.

Furthermore, traders have lost $20.58 million in short and $20.1 million in long positions today at the time of writing. Typically, these spikes in liquidation bars indicate forced exits of Leveraged positions by a trader or a whale. This situation generally occurs due to sharp price movements.

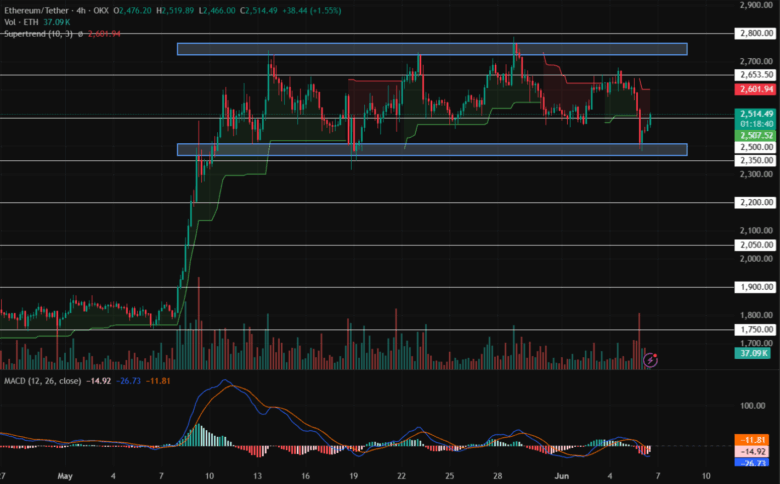

Let us understand the possible short-term Ethereum price prediction. The dominance of the largest altcoin has increased to 9.3% with the Altcoin season indicator displaying a 25, indicating a weak altcoin season. Moreover, this crypto has formed a consolidated price range between $2,350 to $2,750 and continues trading within it since mid-May.

The Moving Average Convergence Divergence (MACD) indicator continues recording a bearish trend in the 4H time frame. Additionally, the histogram displays a fading pattern, suggesting increasing buying pressure in the market. Considering these situations, the Ethereum price could potentially witness a bullish reversal in the shorter time frames.

Adding to this, the Supertrend indicator records increased volatility. As per the trend, the Ethereum token is on the verge of retesting its green supertrend of $2,500, hinting at a major bounce back if buyers come in control.

The supertrend is a technical indicator and shifts spaces between green and red trends to signal the direction of the price trend. It is a crucial indicator as it highlights the buying and selling sentiment of the crypto market.

Will Ethereum Price Recover?

Maintaining the value above the $2,500 mark could result in the ETH coin price heading toward its resistance of $2,650 this weekend. Upper resistance levels for this altcoin are $2,750 and $2,800 if the bulls dominate the market this month.

On the contrary, a breakdown below its key support/resistance level of $2,500 may act as a catalyst in it losing momentum. With this, its lower retest points are $2,350 and $2,300, respectively.

Also Read: Fartcoin Spikes 18% on Coinbase Listing News; How High Can It Go?