Trump’s Truth Social Takes a Swing at Crypto with Bitcoin ETF Filing

Truth Social just threw its hat in the crypto ring—filing an S-1 for a Bitcoin ETF with the SEC. Because what’s a 2025 financial play without a dash of digital asset speculation?

The move signals yet another legacy player trying to cash in on crypto’s volatility—while pretending it’s all about 'innovation.' Will this one actually launch, or join the graveyard of paperwork? Only the SEC (and maybe a few meme traders) know for sure.

Source: SEC

Source: SEC

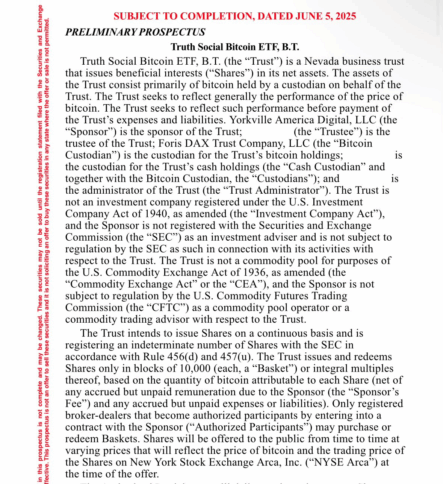

According to the S-1 form, the BT ETF will hold actual Bitcoin. Crypto.com will be the exclusive bitcoin custodian, prime execution agent, and liquidity provider. Yorkville America Digital will sponsor the ETF. Also, shares of the fund are expected to be listed on NYSE Arca, pending approval from the SEC.

The ETF’s filing didn’t reveal important specifics like the ticker symbol, the price of shares, or the initial amount of capital. It only confirmed that the fund will be backed directly by Bitcoin. This means investors can invest in Bitcoin without owning it directly.

The BT ETF will track the real-time price of Bitcoin, just like other existing spot Bitcoin ETFs already on the market. This is just another step taken by the company to expand even further into the fintech space after launching its streaming platform Truth+ and finance brand Truth.Fi.

Meanwhile, Bloomberg ETF analyst Eric Balchunas shared his thoughts on the filing in a post shortly after the announcement “On one hand, uncharted territory because it’s POTUS-linked company, but on the other it’s a late to the party filing in a crowded category where multiple ETFs already are super cheap and liquid.”

For a better understanding, Eric feels Truth Social is entering the ETF space late, where many similar Bitcoin ETFs already exist, and WOULD be very hard for the company’s ETF to stand out in such a crowded and competitive market, even with the president’s name involved

However, the ETF will need SEC approval before it can begin trading. Approval of both the S-1 and the 19b-4 forms is required. The company noted that statements about future performance are forward-looking and not guaranteed, due to various risks and uncertainties.

Also Read: Circle Goes Public on NYSE with $CRCL Listing