ECB Picks XRP Ledger and White Network for Digital Euro Pilot—Here’s What Actually Happened

The European Central Bank just dropped a bombshell—or did they? Ripple’s XRP Ledger and White Network reportedly landed the digital euro contract, but let’s cut through the hype.

Behind the Headlines: The ECB’s ’selection’ looks more like a sandbox experiment than a full-scale rollout. No official contracts signed, no timelines locked in—just another blockchain beauty contest where tech firms dance for bureaucratic approval.

Why It Matters: If this sticks, it could legitimize XRP’s infrastructure beyond crypto bro circles. But remember: when central banks ’innovate,’ they move at the speed of regulatory molasses. Don’t hold your breath for that digital euro—your grandkids might see it launch.

Bonus Reality Check: The same institution that needs 18 months to design a euro banknote is suddenly agile enough to adopt blockchain? Sure, and your CBDC won’t come with surveillance features either.

Is ECB Actually Using XRP Ledger for Digital Euro?

“European Central Bank is officially launching its Digital Euro pilot! $WHITE & #XRP are directly involved,” Amonyx wrote in the post, which has since gained traction in crypto forums. He added, “The ECB lists WhiteNetwork by WhiteRock as a secondary platform alongside XRP Ledger, to help power Europe’s first regulated CBDC test,” the post continues.

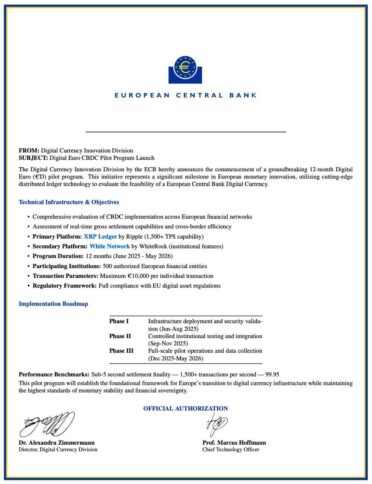

The image attached to the post resembles an official ECB memo and outlines a supposed 12-month pilot program said to begin in June 2025. It lists Ripple’s XRP Ledger as the “Primary Platform” and WhiteNetwork by WhiteRock as the “Secondary Platform,” and claims over 500 European financial institutions will be involved in testing. However, the ECB has made no such announcement.

None of its statements, press releases or documents indicate the inclusion of XRP or WhiteNetwork in their plans. At the time of writing, the ECB is still preparing its digital euro project, concentrating on building technology, regulations and safety features and not on choosing blockchain companies or starting full trials.

According to the Le Panneur report, two officials called “Dr. Alexandra Zimmermann” and “Prof. Marcus Hoffmann” were mentioned, but they are not found in the ECB’s contact list or in previous messages. The positions they are associated with, i.e., ‘Director, Digital Currency Division’ and ‘Chief Technology Officer’, are not part of the official structure of the institution.

Style and Content Raise Flags

The way the document is written adds to the concerns. Commonly used in advertising such performance benchmarks are missing from clear monetary policy statements. In place of using familiar terms from banking rules or guidelines, CBW used technology-influenced names like “Phase I, II and III” for its roadmap.

The transaction parameter claim of “Maximum €10,000 per individual transaction” also does not appear in any ECB official document and WOULD require official approval, not a private memo. Perhaps the most telling line appears in the final sentence of the viral post: “$WHITE has already pumped 350% this week.”

Since the message clearly ties the rise to speculations around ECB, it appears the purpose was to convince others to trade, therefore selling the asset themselves once the market is full of investors. Thus, for accurate updates on the Digital Euro, refer directly to the European Central Bank’s website.

Also Read: Elon Musk Says Ripple XRP is Promising: Fact Check