Bitcoin’s Next Shock Test: What Happens If Powell Walks Away?

Fed Chair Jerome Powell’s resignation could send crypto markets into a tailspin—or become the bullish catalyst Bitcoin maximalists dream about. Here’s how the drama might unfold.

Market Mayhem or Moon Mission?

Powell’s hawkish shadow looms large over crypto. A sudden exit would create immediate volatility, with algos scrambling to price in policy uncertainty. Bitcoin’s 24-hour swings could double current levels as traders gamble on a dovish successor.

The Institutional Wildcard

Wall Street’s recent Bitcoin ETF embrace adds complexity. Would BlackRock and friends see chaos as a buying opportunity—or trigger mass redemptions? Watch the $60K support level like a hawk (no pun intended).

Silver Lining Playbook

Long-term, a Powell departure might accelerate the ’digital gold’ narrative. With less faith in central bankers, retail and whales alike could flood into hard-capped assets. Just don’t expect the Fed to admit crypto was right all along.

Closing Thought: Nothing makes Bitcoin’s fixed supply more appealing than watching the money printers change operators mid-crisis.

Rumors shared on X that powell might resign | Source: X

Rumors shared on X that powell might resign | Source: X

Fews days ago, TRUMP reportedly hosted Powell at the White House in their first official meeting since Trump returned to office. According to White House Press Secretary Karoline Leavitt, the president told Powell that he’s making a mistake by not cutting the interest rate. He cited countries like China as examples of economic advantage.

However, Powell countered, “did not discuss his expectations for monetary policy, except to stress that the path of policy will depend entirely on incoming economic information and what that means for the outlook.” Powell said the Fed will make decisions about monetary policy only “based solely on careful, objective, and non-political analysis.” This adds up to the heated ongoing conflict between them.

Trump has mentioned this a couple of times in the past that he’s going to fire Powell. In April, the President once criticised the Fed Chair, calling for his “termination” for not cutting down the interest rate. Trump later said he had “no intention” to actually fire him but believes Powell should be replaced soon. “Especially if I thought he was doing the right thing,” Trump added in a past interview.

What if Fed Chair Jerome Powell Resigns Early?

What if it did happen? Powell’s resignation would be a major win for the president’s monetary agenda. A new Fed chair would be elected and might probably lean toward a rate cut. A lower interest rate can flood the market with liquidity which could in turn weaken the dollar and push high risk assets like bitcoin even higher.

As interest as this might sound, removing the Fed chair could cause instability in the financial market. In a recent video posted on X, crypto Investor Anthony Pompliano spoke on the matter: He believes two wrongs don’t make a right and this could shake up investors confidence.

“I do not believe that the President of the United States should come in and unilaterally fire the Fed President.” He said, “Where you have a disagreement and then the firing, I think that’s not really the area that we want to go into.”

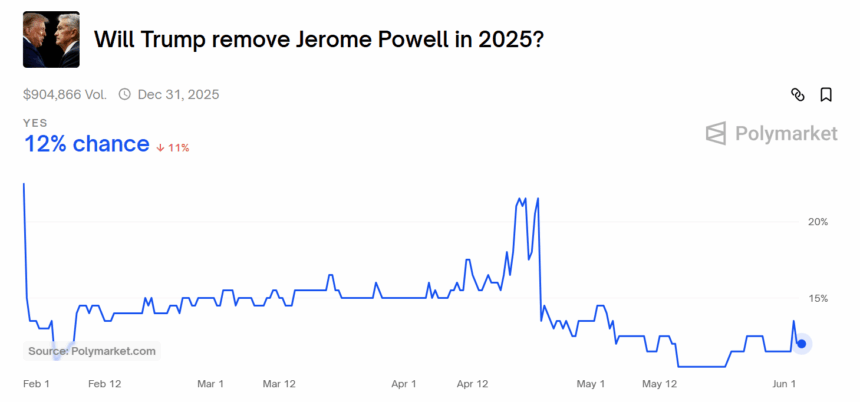

Meanwhile on polymarket, a popular blockchain-based betting platform, traders didn’t seem convinced either. The odds on the question “Will Trump remove Jerome Powell in 2025?” is at 12–14%, with over $904,866 wagered.

Bitcoin Price Could Hit New ATH

The Fed has held rates steady at 4.25% to 4.50% for three straight meetings. Powell has stressed that monetary policy decisions must stay data-driven. However, Trump has made it clear he thinks rates should be slashed now. If he gets his way, that shift could dramatically alter Bitcoin’s price direction.

Meanwhile, Bitcoin price has been experiencing different levels of volatility during the tariff wars and the U.S dollar falling to a three-year low. The uncertainty in the market leads to investors turning to safer assets. As a result Bitcoin hit a new all time high on May 22. However, the price has since dropped 6%. Currently Bitcoin is trading for $104,144, according to CoinMarketCap.

However, this drop does seem like a short retracement. The Relative Strength Index (RSI) on the daily chart is now at 39, and is approaching the oversold territory. This means that the selling pressure WOULD end soon and bulls might take over the market.

Moreover, the overall market is in an uptrend with the price bouncing up from a support zone at $103,000. If the price holds above this zone, we might experience another rally, probably up to $120k, which is about 15% from its current price. So, while Powell hasn’t resigned, and says he won’t if asked. If that question ever turns into a reality, bitcoin price might be the first to react positively.

Also Read: BREAKING: Hong Kong Firm Announces $1.5 Billion Bitcoin Buy Plan