XRP Teeters on Edge as ‘Death Cross’ Threatens $2 Plunge—Or Just Another Overhyped Chart Pattern?

Technical traders are sweating over XRP’s ominous chart formation—but let’s be real, since when did crypto ever follow textbook signals?

The so-called ’death cross’ flashes bearish, yet XRP’s price action has a history of laughing in the face of traditional TA. Remember 2021? Exactly.

Still, the $2 support level looms large. Break that, and even the most diamond-handed bagholders might start sweating. Then again, this is crypto—where ’irrational exuberance’ is just Tuesday.

Bonus cynicism: If charts worked, hedge fund managers would be driving Lambos made of solid gold instead of writing panic emails about SEC filings.

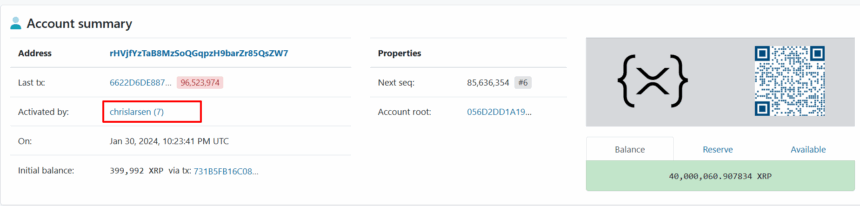

Source: XRP Scan

Source: XRP Scan

Will XRP Price Fall to $2?

Despite the bullishness in the community, xrp price continues to tumble since mid-May. XRP ETF approval odds, inclusion of XRP in the US strategic reserve, and companies buying XRP as a reserve asset were among factors behind the bullish sentiment.

XRP price currently trades at $2.17, moving sideways over the past 24 hours. The 24-hour low and high are $2.13 and $2.19, respectively. Furthermore, the trading volume has increased just 4% in the last 24 hours, indicating a muted interest among traders amid tariff concerns.

XRP price has formed a ‘death cross’ pattern in the daily timeframe. This forms when the 50-SMA (blue) crosses below the 200-SMA (red), indicating a weakening market trend. Other indicators, including Bollinger bands and exponential moving average (not shown here), also hinted at a likely fall in prices.

Moreover, RSI is at 40 and continues to move NEAR the oversold zone. However, traders may buy the dip if the market condition improves after tariff fears fade.

XRP price rise was driven mainly by Leveraged positions, signaling increased risk in the market. “This could eventually present a good shorting opportunity, provided it’s carefully managed,” as per CryptoQuant.