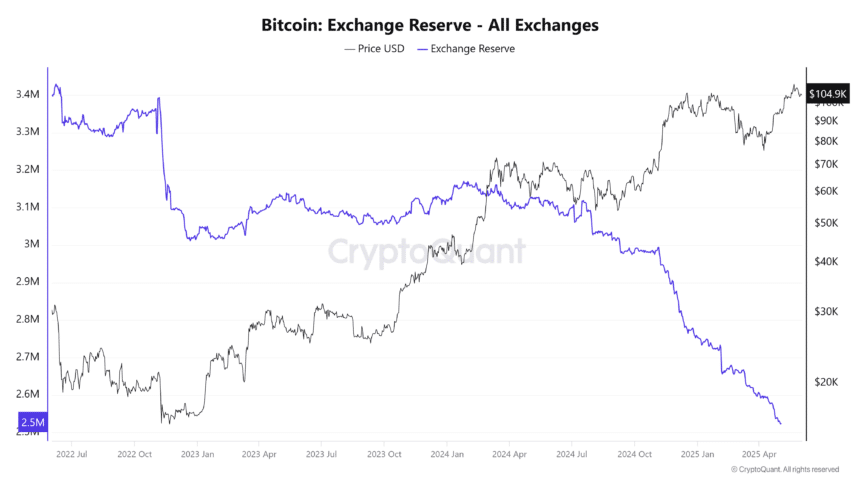

Crypto Exodus Accelerates: Exchange Bitcoin Reserves Plummet Under 2.6M BTC

Bitcoin’s great migration hits a milestone—exchanges now hold less digital gold than ever. Traders are voting with their wallets, and the numbers don’t lie.

Why the rush for the exits? Call it self-custody fever, regulatory jitters, or just Wall Street finally learning what a cold wallet is. Either way, the ’not your keys’ crowd is winning.

One cynical take? Exchanges might need to start offering yield on those dwindling reserves—old habits die hard in finance.

Source: CryptoQuant

Source: CryptoQuant

Institutional buying plays a major role. Strategy added 7,390 BTC in May, boosting its total to 576,230 BTC about 2.75% of the total supply. GameStop and Japan’s Metaplanet also ramped up their holdings, while spot bitcoin ETFs saw $5.23 billion in inflows.

Even governments like the UAE and Pakistan are increasing their Bitcoin stacks, and U.S. lawmakers are discussing a national Bitcoin reserve.

Bitcoin is still above its 200-day EMA and SMA. Yet, the pace of the recovery is not consistent. The RSI is currently 52, which suggests it is neutral, and short-term signals suggest dips may occur.

If Bitcoin holds above $106,000, there is a chance it could reach $110,000. If support is not held, prices could fall toward $98,000 or even lower. Volatility will be a factor in the NEAR future.

Also Read: Bitcoin price prediction June 2025: BTC to Smash $120K Goal?