CRO Rockets as Canary Pushes for Staked Cronos ETF—Wall Street Plays Catch-Up

Crypto.com’s native token CRO just got a turbocharge—Canary Capital filed paperwork for a staked Cronos ETF, and the market’s already pricing in the hype.

Why it matters: Traders are piling in, betting regulators will rubber-stamp this faster than a VC’s seed round. The move could funnel institutional cash into Cronos’ staking ecosystem—assuming the SEC doesn’t throw its usual regulatory tantrum.

Between the lines: Another day, another crypto ETF scramble. Wall Street’s still trying to figure out DeFi while retail traders front-run the suits. Stay tuned—this could get messy (or lucrative).

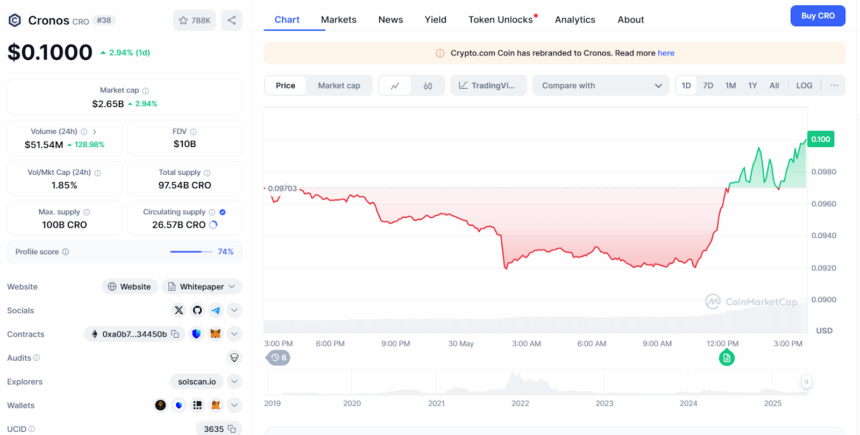

CRO Price | Source: CoinMarketCap

CRO Price | Source: CoinMarketCap

According to the press release, this proposed fund called the Canary Staked CRO ETF, will give investors direct exposure to the price of CRO while earning additional CRO through staking. The trust holding the CRO tokens will be based in Delaware, and all assets will be stored by Foris DAX Trust Company, which operates under the name Crypto.com Custody Trust Company while all staking operations will be carried out through validators.

Staked CRO will go through a 28-day unbonding period before it can be moved or withdrawn. Additionally, a unified annual fee will apply, though the exact percentage is not yet shared. The ETF’s trading symbol is also currently not disclosed.

In the press release, Eric Anziani, president and COO of Crypto.com noted that “ETFs have been an effective means for broadening investor participation in crypto and further integrating digital and traditional finance capabilities.” He also said he’s excited to “to see this important step being taken in building towards all investors in the U.S. having the opportunity to engage with CRO through an ETF with Canary Capital

Meanwhile, this filling adds to many partnerships between Canary Capital and Crypto.com. Recently on May 19, both companies announced a partnership to establish Canary CRO Trust, a private vehicle for accredited U.S. investors to gain exposure to CRO. If this new ETF gets approved, it will be the first staked Cronos ETF in the U.S. Moreover, Canary Capital is also working on other staking-based crypto funds, like ETFs for TRON (TRX) and Sei Network (SEI).

However, the SEC issued a statement on May 29 to clarify that most staking activities on proof-of-stake blockchains do not fall under securities laws. The agency explained that staking rewards are compensation for providing network services, not returns from investment contracts.

Also Read: Hoffman: Grayscale Sees Litecoin ETF by Oct, LTCN at 6% Discount