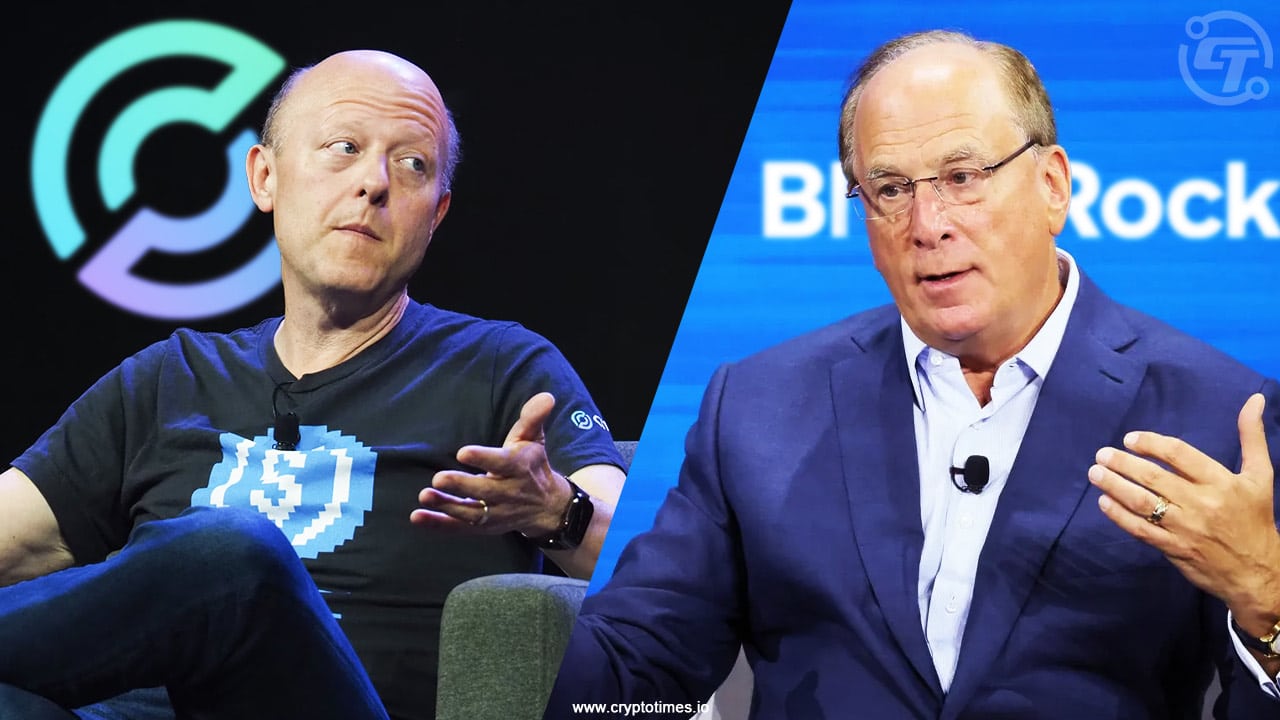

BlackRock Makes Power Play: Snags 10% Stake in Circle’s IPO

Wall Street’s quiet giant just placed a billion-dollar bet on crypto’s infrastructure future.

BlackRock—the $10 trillion shadow that moves markets—just took a 10% chunk of Circle’s hotly anticipated IPO. No whispers, no warnings. Just a classic institutional power move dressed as ’strategic partnership.’

Why it matters: When the world’s largest asset manager starts accumulating stablecoin-adjacent equity, even Bitcoin maxis check their charts twice. This isn’t your cousin’s meme coin gamble—it’s TradFi quietly building moats around the next financial system.

The cynical take: Nothing cures crypto skepticism like seeing 10% ROI potential in regulatory paperwork. BlackRock didn’t survive 30 years by taking risks—they survive by owning the casino.

BlackRock & Ark Invest Eye Positions in Circle IPO

Circle, which oversees the USDC stablecoin, has decided to sell 24 million shares of its Class A common stock through the IPO, according to a latest release. The company will issue a total of 9.6 million new shares and another 14.4 million will be sold by existing owners. Underwriters have the right to buy 3.6 million more shares within a 30-day period, which could increase the total offering to 27.6 million shares.

The Circle IPO share price is likely to stay between $24 and $26. If every investor signs up for the full amount, Circle could gain as much as $624 million. All of the revenue from the 9.6 million shares being issued will be transferred to Circle. Money raised from the sales of existing shareholders’ shares will not be used by the company itself.

It was also revealed in the SEC filing that Ark Investment Management, under Cathie Wood, might put up to $150 million in this stock offering. Preliminary demand for the IPO is said to be greater than the supply of shares made available. The company aims to price the offering on June 4.

Since BlackRock runs the Circle Reserve Fund, it already maintains a partnership with Circle. It manages the government money market fund that holds 90% of the reserves backing the USDC stablecoin. At the end of April 30, 2024, the fund’s net assets totaled nearly $30 billion.

Sources indicated that BlackRock could execute the share purchase through an affiliated entity or investment vehicle, according to a Bloomberg report. However, final decisions have not been made yet. Meanwhile, both Circle and BlackRock have declined to comment on the matter.

Also Read: Circle IPO Timeline: What Will be the Share Price?