Trump Media’s $2.5B Bitcoin Bet Backfires—DJT Stock Plunges 9%

Another ’stable’ investment strategy from the political playbook.

Trump Media & Technology Group’s grand crypto pivot hits a wall as DJT shares nosedive—turns out slapping ’Bitcoin’ on a $2.5B plan doesn’t magically print money. Who knew?

The selloff sparks fresh doubts about meme-stock meets crypto hype cycles. But hey, at least the volatility is on-brand.

Trump Media Announces $2.5B Bitcoin Treasury

According to the press release, the company plans to raise $1.5 billion through common stock and $1 billion through zero-interest convertible senior secured notes. About 50 institutional investors have agreed to the deal, which is expected to close by May 29, 2025. Crypto.com and Anchorage Digital will manage the custody of the bitcoin holdings.

Trump Media said the goal is to build a large Bitcoin treasury. In the press release, CEO Devin Nunes explained, “We view Bitcoin as an apex instrument of financial freedom, and now Trump Media will hold cryptocurrency as a crucial part of our assets.”

He added that the company plans to evolve into a holding company owning high-value assets aligned with “America First” principles. The money raised will also help expand Truth Social and support fintech projects under the Truth+ and Truth.Fi brands.

The common stock will be priced at the last market close, while the convertible notes come with a 35% premium and 0% interest. The private placement means the offer is only for selected investors, not the public.

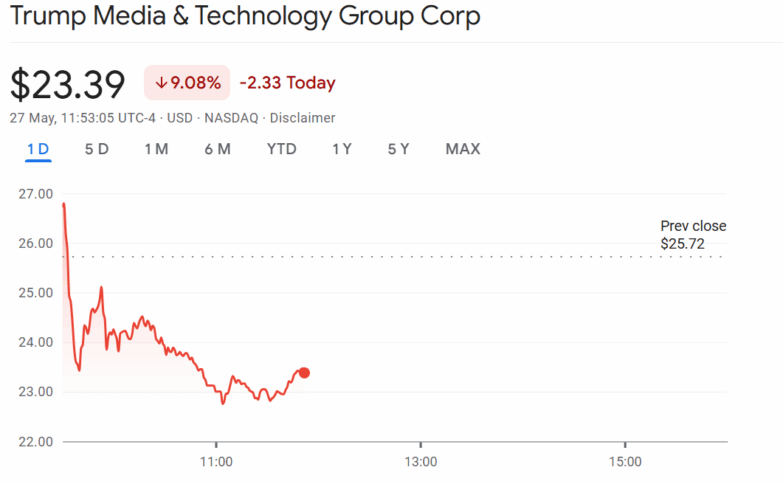

DJT Stock Crashes 9%

Following the news, DJT initially jumped more than 10% in premarket trading but dropped after and now trades for $23.39. Meanwhile, The stock has dropped over 26% since the beginning of the year.

At the end of the first quarter of 2025, TRUMP Media had $759 million in cash and short-term investments. Bitcoin will join the assets on the company’s balance sheet. The placement agents helping with the deal include Yorkville Securities, Clear Street, BTIG, and Cohen & Company. Cantor Fitzgerald acted as the financial advisor.

Moreover, this is one of the largest BTC treasury announced by a public company recently. Devin Nunes explained that the Bitcoin investment supports the company’s goal to “defend our Company against harassment and discrimination by financial institutions.” He also said that Bitcoin will create synergies for subscription payments, utility tokens, and other transactions on their platforms.

Peter Schiff Criticizes the Move

In a post on X, Peter Schiff, a well-known Gold supporter and Bitcoin critic, related to the plan. He said DJT dropped probably because the market is tired of more companies building treasuries. He also questioned how the company could create a Bitcoin reserve using investor funds while Trump himself had already bought BTC privately.

Schiff questioned, “Also, how can Trump’s company front-run the strategic Bitcoin reserve, using taxpayers’ dollars to pump up what he bought first?” This comment adds to the debate around the company’s Bitcoin strategy as it implies that the MOVE might unfairly boost Trump’s own holding.

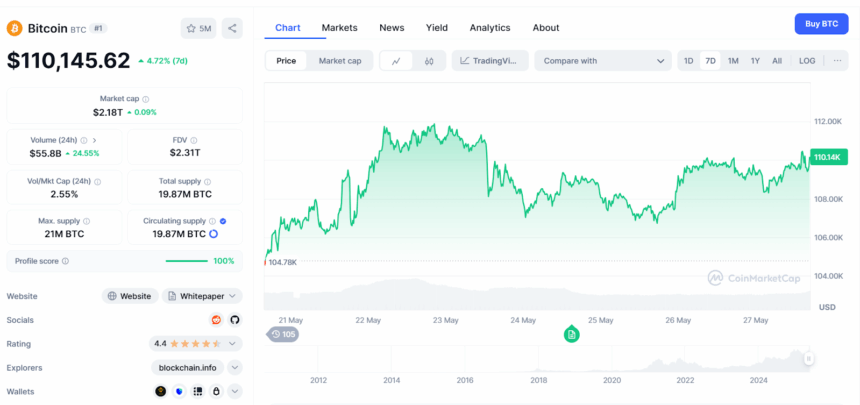

Meanwhile, Bitcoin price reacted to the news positively and surged above $110,000. As of the time of writing, the BTC price is trading for $110,145, a 4.72% surge recorded in the last 24 hours with a 24.55% increase in trading volume to $55.8 billion

Also Read: Trump Media Group Denies Raising $3B For crypto Investments