Bitcoin 2025 Conference: Catalyst for the Next BTC Bull Run?

As the crypto world descends on Miami for Bitcoin 2025, traders are laser-focused on one question: Will this event spark the next parabolic rally?

The conference has historically coincided with market inflection points—but this time, Wall Street’s petro-dollars are elbowing in alongside the OG hodlers.

Between institutional adoption panels and mining CEO keynote platitudes, watch for these three signals that could light the fuse...

Just remember: in crypto, every ’game-changing’ announcement comes with a side of bag-holder opportunities.

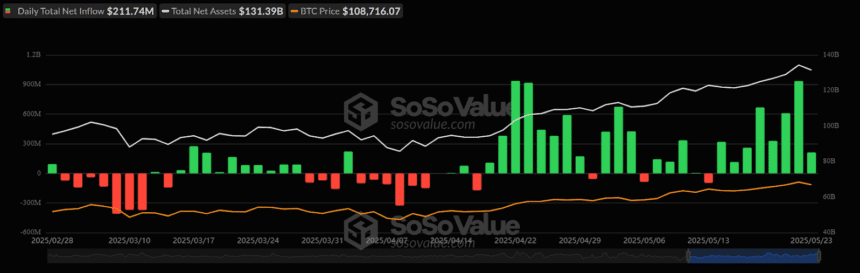

Bitcoin ETF Records 8 Consecutive Days Of Positive Streak

The BTC ETF has concluded another week on a bullish note by recording a positive inflow for all five working days. Reportedly, 6 ETFs displayed a positive FLOW during this period, 3 ETFs recorded a neutral flow, and 2 ETFs recorded a negative flow during this week.

BlackRock’s “IBIT” recorded the highest inflow of $2,432 million, followed by Fidelity’s “FBTC” with $209.9 million. While Franklin, Valkyrie, and WTree recorded neutral flow, Grayscale’s “GBTC” recorded the negative flow of $89.2 million, followed by Invesco’s “BTCO” with $5.3 million. The net inflow for the week concluded at $2.75 billion, resulting in the Bitcoin ETF maintaining its positive flow for 8 days.

Bitcoin Price Today Retests $110,000

The BTC price has maintained its value above the $109,000 mark with an intraday jump of approximately 2%. Moreover, with a trading volume of $46.72 billion, this cryptocurrency token has dominance of 63.22% of the total market valuation.

The Relative Strength Index (RSI) is on the verge of breaching out its overbought range in the daily time frame. Moreover, its average trendline continues hovering around the upper price range, indicating a positive outlook for the largest crypto token in the market.

Adding to this, the SMA indicator constantly supports the BTC price chart in the 1D chart. Considering the present market sentiments, the price of Bitcoin may continue gaining momentum this week.

Will BTC Price Rise Again This Week?

If the bulls maintain the value of BTC price above the $109,000 mark, it could result in the crypto token heading toward its ATH of around the $112,000 mark. A sustained positive action may set the stage for it to achieve its $116,000 level.

On the flip side, if the bears dominate the crypto space, the price of BTC token could drop toward its immediate support of $108,000. Furthermore, if the bearish sentiment intensifies, this could result in it plunging toward its lower support range of $105,000 this month.

Also Read: bitcoin price Reclaims $110K: 3 Reasons Fueling the Surge