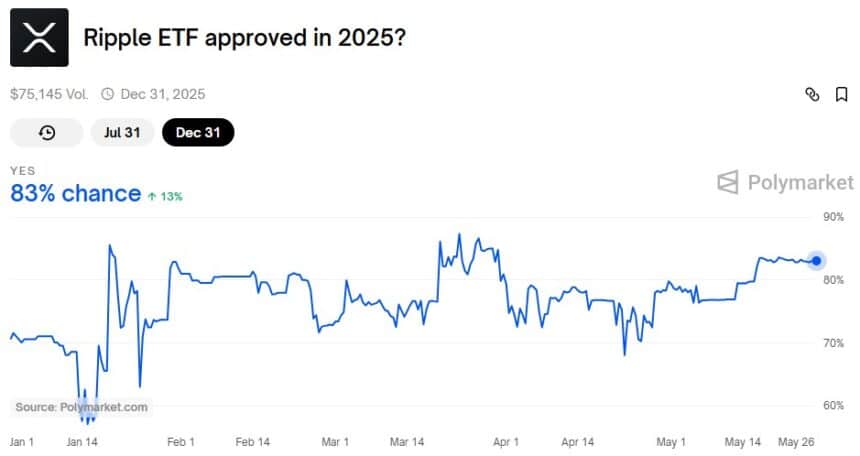

XRP ETF Approval Odds Skyrocket to 83%—Wall Street Starts Paying Attention

Polymarket’s latest odds suggest an XRP spot ETF is almost a done deal—because nothing gets regulators moving like a bandwagon already rolling.

After years of regulatory limbo, the crypto crowd’s favorite courtroom drama token might finally get its mainstream moment. The prediction market now prices in an 83% chance of approval this week, up from single-digit hopes just months ago.

Behind the surge? Probably some hedge fund manager finally realizing they’re missing the ’digital asset’ slide in their PowerPoint deck. Because in modern finance, if you can’t slap ’ETF’ on it, does it even exist?

Source: Polymarket

Source: Polymarket

Meanwhile, Ripple CEO Brad Garlinghouse remains confident about ETF growth. On Ripple’s podcast Crypto in One Minute, he said ETFs help institutional investors enter the crypto market without dealing with crypto exchanges or self-custody. “Wall Street has struggled to access crypto directly,” he explained. “ETFs offer a safer and more regulated entry point.”

Garlinghouse also highlighted the rapid success of Bitcoin ETFs, noting they hit $1 billion in assets faster than any ETF in history. He expects XRP ETFs to follow a similar path.

Adding to the momentum, Volatility Shares recently launched the first-ever XRP futures ETF on Nasdaq under the ticker XRPI. This follows the launch of XRP futures on CME Group’s platform earlier this month.

Tectrium introduced a 2x Long Daily XRP ETF, indicating that institutional traders are showing more interest. Such products are probably increasing investors’ trust and making it more likely that an XRP ETF will be approved.

Also Read: Spot XRP ETFs Only a Matter of Time: Nate Geraci