Crypto Whale Bets $276M on Bitcoin’s Surge With 40X Leverage—Regulators Already Napping

A single trader just dropped a jaw-dropping $276 million long position on Bitcoin—leveraged 40X—via Hyperliquid. This isn’t just a bet; it’s a high-stakes declaration that crypto’s bull run has legs.

Why This Move Screams Confidence

Leverage at this scale isn’t for the faint-hearted. The whale’s play suggests ultra-short-term conviction in Bitcoin’s upside, despite the gut-churning volatility that comes with crypto’s wild west.

The Irony?

While Wall Street frets over ’risk management,’ crypto’s big players keep doubling down. Meanwhile, traditional finance watches from the sidelines—still trying to figure out if blockchain is a spreadsheet or a scam.

One thing’s clear: When whales move, markets ripple. Whether this trade fuels Bitcoin’s next leg up or becomes a cautionary tale, it’s a reminder—crypto doesn’t wait for permission.

Source: X

Source: X

Leverage lets traders borrow money to make bigger bets. But with 40x leverage, even a small drop in price like 2.5% can wipe out the entire position. So, this whale is definitely taking a big gamble, betting hard that Bitcoin will keep climbing.

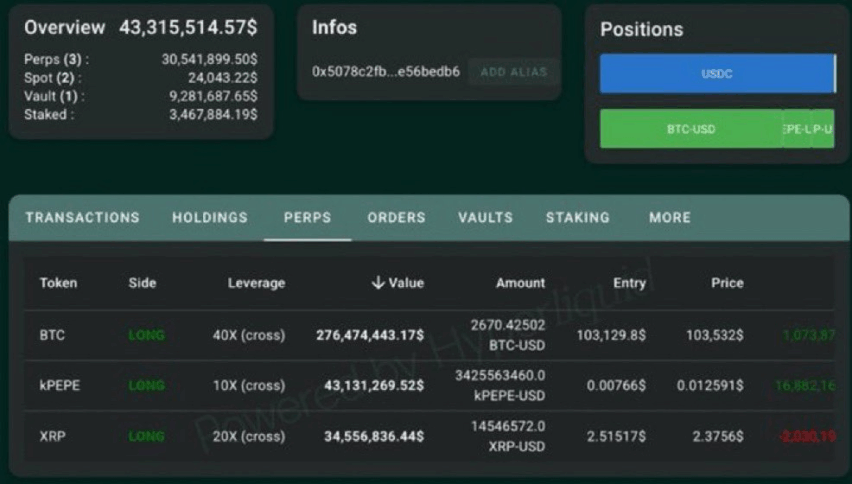

This whale’s wallet, tagged as 0x507..6ebd6, holds more than $43 million across other bets too. Besides Bitcoin, the whale is long on Pepe with $43.13 million at 10x leverage and XRP with $34.56 million at 20x leverage as well.

Earlier this year, another whale made a huge $524 million short bet on Bitcoin, also at 40x leverage. That bet was placed near $83,898, with liquidation just above $85,565. If BTC price spiked past that the whole short would be wiped out.

Right now, the bitcoin price sits at about $103,094, down just 0.9% over the last day. Trading volume has dropped 21% to $37.42 billion, with a total market cap of $2 trillion, according to CoinMarketCap.

Also Read: bitcoin Price will Hit $250K by 2025: Robert Kiyosaki