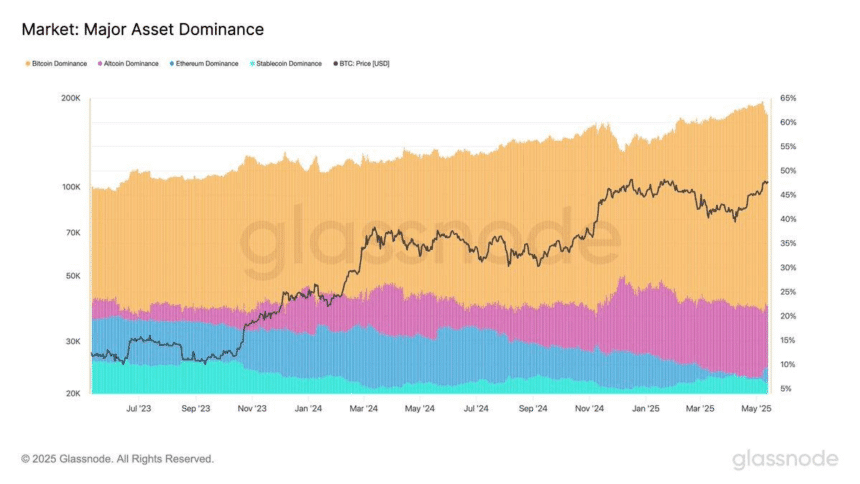

Bitcoin’s Grip Slips to 61.6% as Ethereum and Altcoins Stage a Coup

Crypto’s old guard stumbles as ETH and altcoins eat Bitcoin’s lunch—proof that even digital gold gets tarnished when traders chase the next shiny thing.

The dominance drop signals a market hungry for risk—or maybe just desperate to pretend 2022 never happened. Wall Street analysts are already drafting their ’I told you so’ reports.

Meanwhile, Ethereum’s merge-fueled momentum keeps defying the ’flippening’ doubters. Altcoins? They’re either the future or future bag-holders—pick your narrative.

Funny how decentralization always seems to centralize around whichever coin pumped last. The more things change...

Crypto Dominance

Crypto Dominance

Earlier this week, Bitcoin reached a high of $105,800 but then slipped back below $103,000. It’s now trading at around $102,687, according to CoinMarketCap. The drop makes sense because Bitcoin was close to its all-time high but didn’t quite make it. While Bitcoin price is near a record high, many altcoins are still 60% to 80% below their highest prices, so investors see potential in these smaller coins.

The Bitcoin rally started on May 6 when the price first jumped from $93.8K to $103.6K, but since then, price action has slowed. Ethereum, however, has picked up steam with a 13.4% jump in the past five days, leading the altcoin rally. Moreover, traders are also taking recent geopolitical developments into consideration.

According to The New York Times report, the peace talks between Russia and Ukraine were set to happen in Turkey, but the chances of the outcome look dim as neither Russian President Vladimir Putin nor U.S. President Donald TRUMP will be attending. Instead, delegates will attend the meeting. The outcome of the meeting can boost confidence in the market and support risk assets like Bitcoin

Meanwhile, data from CoinGlass shows that Bitcoin’s long-to-short ratio dropped to 0.92, which is the lowest in over a month. A number below 1 means more traders are betting against BTC. However, some bullish signs remain.

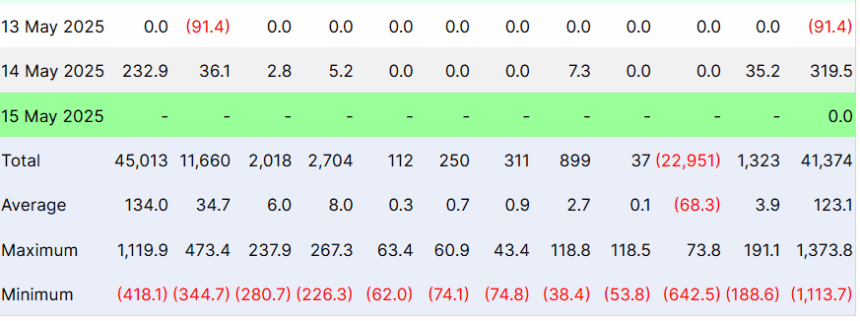

U.S. spot bitcoin ETFs saw inflows of $319.56 million on Wednesday, bouncing back after a $96.14 million outflow on Tuesday, according to Farside. Analysts note that sustained ETF inflows could help support BTC’s next move.

Also Read: Bitcoin can hit $500k, people will call it asset: Anthony Scaramucci