Solana Gamblers Double Down on $200 SOL Price Target Before June

Solana traders are throwing caution—and capital—at June contracts betting on a moonshot to $200. The altcoin’s recent volatility has turned options markets into a high-stakes casino, with OI for June $200 calls spiking 300% in 48 hours.

Behind the frenzy: A mix of ETF speculation and post-memecoin liquidity sloshing into SOL. Never mind that the token hasn’t touched its November 2021 ATH since... well, November 2021.

Wall Street’s old ’buy the rumor, sell the news’ playbook gets a Web3 makeover—this time with 24/7 leverage and influencer pump squads replacing research analysts. What could go wrong?

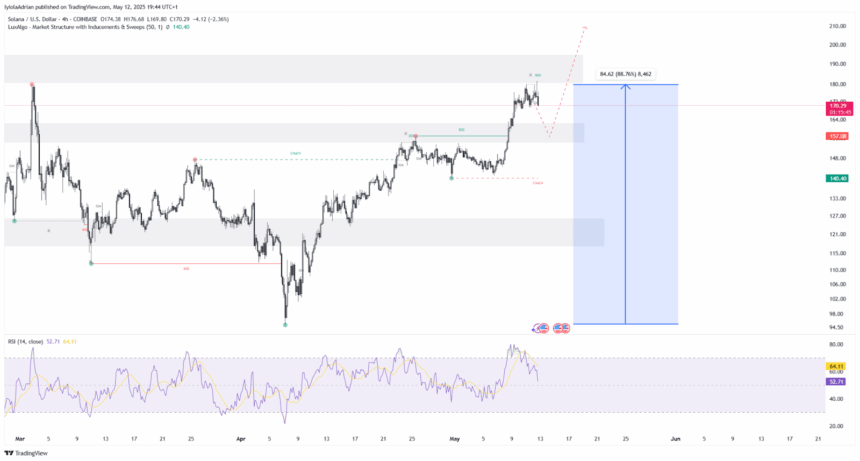

ADA/USD 4-Hour Chart | Source: TradingView

ADA/USD 4-Hour Chart | Source: TradingView

These traders, often called block traders, handle big deals outside public exchanges. They’ve been buying large amounts of call options that expire on June 27, with a strike price of $200. A call option gives the buyer the right, but not the obligation, to buy an asset at a fixed price in the future. It’s a bullish bet and traders believe the price will rise above that level.

“Traders also got long the $200 June expiration last week. This was the biggest block trade, trading 50,000x contracts in total for $263,000 in premium,” said Greg Magadini, director of derivatives at Amberdata, in an email.

On Deribit, one contract equals one SOL, so the size of the trade shows strong conviction. The traders bought these calls when implied volatility was 84%, which is lower than usual for SOL. This means they got in at a cheaper price compared to normal levels, which often sit in the triple digits.

Due to these trades, market makers now have what’s called a “net negative gamma” at the $200 strike. This means they might need to buy SOL as its price goes up and sell as it drops to stay balanced. This kind of trading can lead to bigger price swings in both directions.

If SOL price gets close to $200, that extra buying and selling could push the price higher or make it bounce around more. These actions can create fast moves in the market, especially when a lot of money is involved.

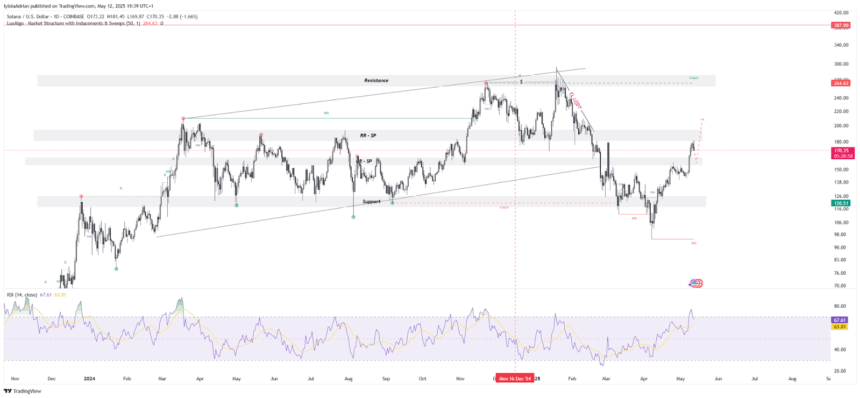

Looking at the chart on the Higher timeframe, SOL took liquidity on April 5 which gave it the momentum it needed to surge. The price has since broken through two resistance levels, first at $120, then the recent one at $162 on May 8.

As of now, the Solana price is testing another resistance level at $180. The price is currently showing signs of rejection that it wants to reverse but there is no confirmation of change in trend yet. If the price refuses to break this level, it might retest the level at $162 which is now a resistance-turned-support zone before starting another rally.

Also Read: dogwifhat price Prediction: Solana’s WIF to Hit $1.5 This Week?