MARA Stock Surges 9% as Bitcoin Miner Slashes Costs—Wall Street Pretends to Care About Efficiency

Marathon Digital’s stock rockets as the miner tightens its belt—proof that even crypto plays still bow to old-school cost-cutting gods.

The Numbers Don’t Lie

MARA shares ripped higher after Q1 earnings revealed aggressive operational trimming. Because nothing excites traders like a crypto company acting... responsible.

Crypto Meets Corporate Reality

The ’growth at all costs’ era fades as miners face post-halving economics. MARA’s move signals what every investor secretly knows: blockchain is revolutionary, but balance sheets still matter.

Watch for copycat moves across the sector—and the usual analysts flip-flopping between ’crypto is dead’ and ’this time it’s different’ tomorrow.

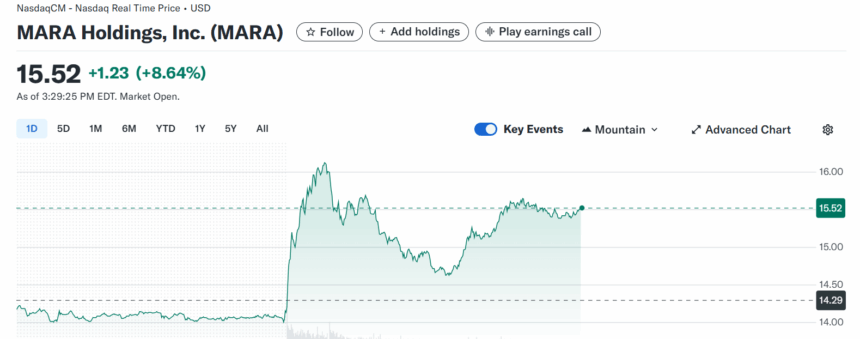

MARA’s Current Price | Source: Yahoo

MARA’s Current Price | Source: Yahoo

Jefferies analysts pointed out that the recent increase in bitcoin price, combined with MARA’s shift toward using more sustainable energy sources. It includes solar and flared gas-driven data centers, will likely lower the company’s power costs in the coming months.

Jonathan Petersen, an analyst at Jefferies, said that the company’s infrastructure expansion, including a 114 MW wind farm and a newly energized 25 MW micro flared gas data center WOULD help drive down energy costs, improving profit margins moving forward. “MARA is expanding infrastructure at its 114 MW wind farm and has fully energized its 25 MW micro flared gas data center,” Petersen explained.

Analysts are optimistic that if MARA continues to invest in energy assets, it will be able to cut costs even further, improving its profitability. Petersen raised his price target for the stock to $16 from $13, maintaining a “hold” rating.

The Bitcoin mining sector has struggled recently, with many miners’ profit margins squeezed by falling prices and rising energy costs. In response, some miners have turned to alternative sources of revenue, such as artificial intelligence and high-performance computing (HPC).

MARA, however, has stayed focused on diversifying within its Core business, focusing on revenue from transaction services, mining pools, and cutting energy costs via green energy sources.

H.C. Wainwright analyst Kevin Dede emphasized MARA’s strategy to stay ahead of competitors. “The company remains focused on technology development in its CORE vertical of power conversion,” Dede said.

He believes MARA’s approach will continue to give it an edge in the industry. Dede, who has a buy rating on the stock with a target of $28, also agreed that the company’s focus on improving power efficiency will help them succeed.

Also Read: US Vice President JD Vance To Speak at Bitcoin 2025 Conference