Bitcoin Smashes $104K as Whale Alert: New Wallet Inflows Signal Market Frenzy

Bitcoin just bulldozed through the $104,000 barrier—marking another surreal chapter in its bull run. On-chain data shows a tsunami of new wallet addresses, suggesting retail FOMO is kicking in just as institutions start quietly taking profits (classic).

Behind the surge: A perfect storm of ETF inflows, halving scarcity mechanics, and that one hedge fund manager who finally admitted ’maybe crypto isn’t a scam.’ Meanwhile, Wall Street still can’t decide if this is digital gold or a dangerously volatile tech stock—so they’re hedging both ways.

Warning label: Past performance guarantees future bankers will find new ways to overcomplicate it.

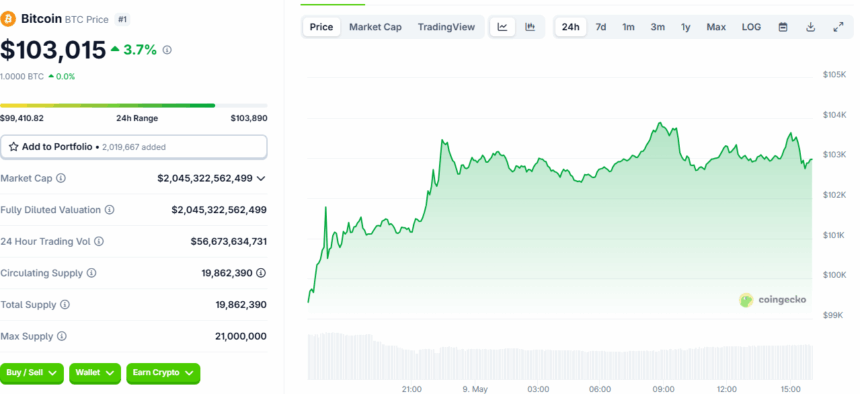

BTCUSD Price Chart | Source: CoinGecko

BTCUSD Price Chart | Source: CoinGecko

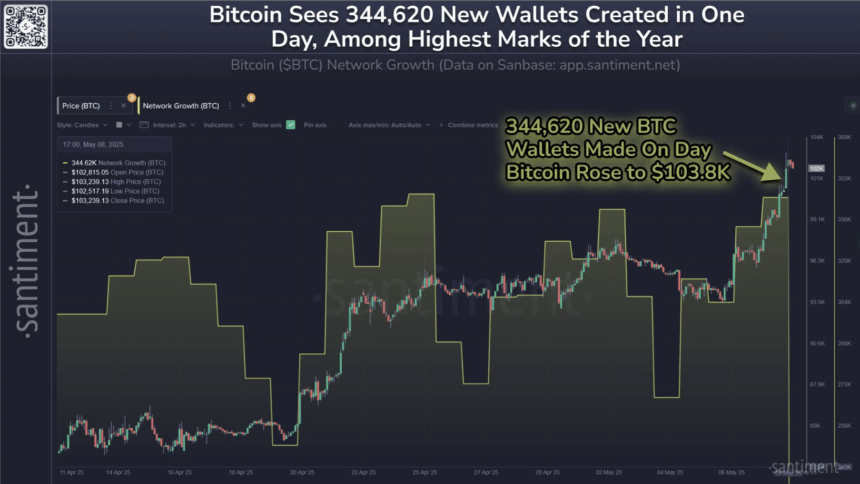

The spike in wallets began on May 4 as Bitcoin started climbing. New wallets are often a sign that more everyday people are joining the action.

On-chain data from Santiment showed bitcoin network activity increasing across several metrics. New addresses went up by 8.13%, active users by 8.79%, and zero-balance wallets becoming active jumped by 11.35% in the past week.

As the price moved higher, Bitcoin’s network became busier with both new and returning users. Activity picked up sharply as prices crossed $103,000. This kind of trend means more people are funding wallets and jumping into the market. Many had been inactive before the rally began.

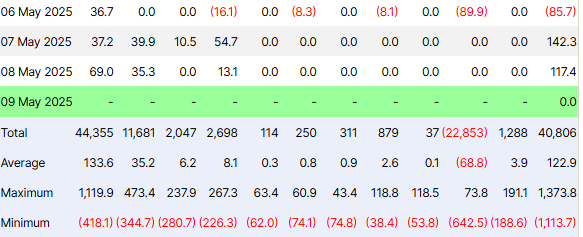

In the background, a wave of liquidations hit traders betting against Bitcoin. Coinglass data shows that $343.99 million in derivatives positions were wiped out within 24 hours, $320.96 million of that from shorts. A short squeeze happens when prices rise and force short sellers to exit fast, often by buying Bitcoin themselves, which drives prices up more.

Meanwhile, spot Bitcoin ETFs attracted strong inflows. According to Farside Investors, a total of $142.3 million flowed into funds on May 7. ARK 21Shares saw $54 million, Fidelity brought in $39 million, and BlackRock added $37 million. On May 8, IBIT led with $69 million more.

As prices soared, Bitcoin’s market cap ROSE above Amazon’s, reaching $2.040 trillion, based on data from SoSoValue. It now ranks fifth among global assets, just behind Gold, Microsoft, Apple, and NVIDIA, according to SosoValue.

Also Read: Hayes: Bitcoin to Hit $1M by 2028 as U.S.-China Deal Falters