Bitcoin Smashes Through $100K Barrier—Saylor Doubles Down on $200K Prediction

Bitcoin’s bull run isn’t just back—it’s breaking records. The flagship cryptocurrency surged past $100,000 today, marking its second all-time high this month. MicroStrategy’s Michael Saylor, never one for understatement, immediately upped his price target to $200K during a CNBC interview.

Why the frenzy? Institutional inflows are flooding in faster than a degenerate gambler’s margin call. BlackRock’s spot ETF now holds over 300K BTC, while sovereign wealth funds quietly accumulate. Retail FOMO? Still MIA—this rally’s being driven by whales and corporate balance sheets.

Saylor’s prediction hinges on Bitcoin eating gold’s market cap: ’It’s not speculation when the math is inevitable.’ Traders meanwhile are watching the $110K resistance level like hawks—break that, and even the skeptics might stop calling it a ’ponzi scheme.’

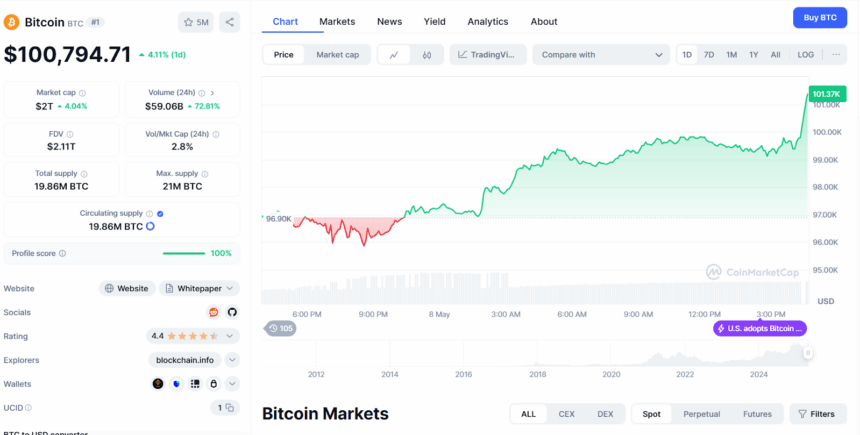

BTCUSD Price Chart | Source: CoinMarketCap

BTCUSD Price Chart | Source: CoinMarketCap

Bitcoin was able to achieve this as the market’s dominance increased above 60%. This means investors are putting more focus on bitcoin now and less on other altcoins.

Previously, during Bitcoin’s $100,000 spikes in December and January, its dominance was much lower, hovering around 52% and 54%, respectively. Now, this new dominance level shows that there is a shift in the way the market perceives things, which could be a potential challenge for altcoins.

Meanwhile, the surge comes due to the ongoing mix in politics, and economic reasons. The rise is linked to a possible trade deal between the United States and the United Kingdom, which TRUMP mentioned on May 7 in a Truth Social post.

Besides the events in politics, there’s also the issue of falling bond yields and a weakening dollar which looks to have contributed to the rally. Additionally, interest from institutional bodies is still rising with Bitcoin exchange-traded funds (ETFs) seeing $1.8 billion in inflows in the past week alone, according to Farside Investor.

Now, the rally is expected to continue. Ben Caselin, chief marketing officer at VALR, even suggests that Bitcoin could soon surpass $110,000. He believes, “Retail is only set to come in toward what is traditionally the latter part of the Bitcoin four-year cycle, which might see a macro top reached in Q4 of this year.”

Following the recent gains, Saylor posted on X, “You can still buy $BTC for less than $0.2 million.” This implies that people should take the opportunity to buy Bitcoin now, while it is still under $200,000, a target Saylor is extremely bullish on.

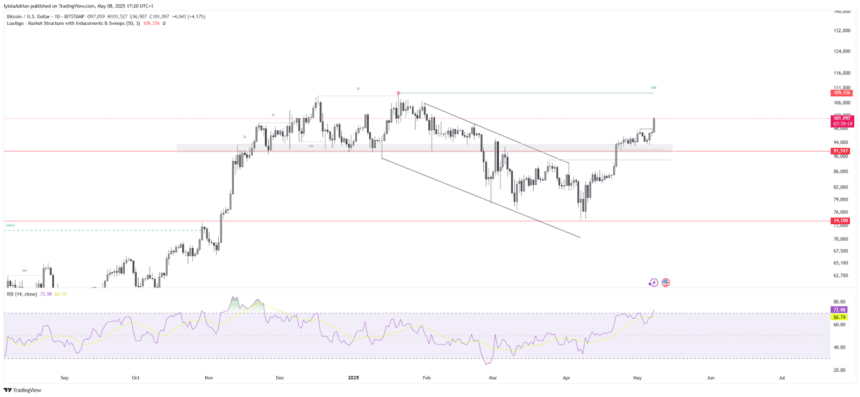

Looking at the daily chart, the price rally started after bouncing off a resistance-turned-support level at $93,645. Right now, the Relative strength index (RSI) is at 76 which means the bulls are actively in control.

As Bitcoin maintains its dominance and breaks new records, the future of the cryptocurrency market appears increasingly bullish. However, experts warn that for the rally to sustain, it will depend on key upcoming economic data, such as the US budget report and Consumer Price Index (CPI) data.

Also Read: Trump Advisor David Bailey Raises $300M for Bitcoin Investment